Affiliate links on Android Authority may earn us a commission. Learn more.

FCC Chairman Ajit Pai accused of cherry-picking data to repeal net neutrality

Chances are, especially if you reside in the US, you’ve heard a thing or two about net neutrality. There are those who are in firm support of net neutrality – most tech giants like Amazon and Google, for instance – and there are those who are adamantly against it, currently including the FCC.

FCC Chairman Ajit Pai has made it very clear that he would be doing everything he can to scale back some of the regulations around Internet Service Providers (ISP) in the US and how they choose to use their networks. As part of his argument, Pai has repeatedly cited a drop in investment from wireless companies during 2016, a year after net neutrality rules took effect. However, it looks like he overlooked some important statistics from other years which could prove that there is no causation involved here.

Brief background on net neutrality

For those of you who are not familiar with the issue, net neutrality essentially aims to regulate the wireless industry so that all content on the Internet is treated equally. Under this set of rules, networks cannot collect fees to prioritize certain information, and they cannot discriminate against websites and services that rely more heavily on data. During the Obama administration, the FCC actively advocated for and eventually approved these rules under the guidance of former Chairman Tom Wheeler.

Net neutrality essentially aims to regulate the wireless industry so that all content on the Internet is treated equally.

Since the 2016 election in the US and the appointment of Ajit Pai as the new Chairman of the FCC in January 2017, however, the organization’s attitude towards net neutrality changed drastically. Dominated by Republican-affiliated former businessmen, the FCC now wants to undo the classification of ISPs as “Title II” common carriers and gut net neutrality in order to create positive economic effects.

The agency has already voted to move forward with Pai’s plans, which prompted 40 tech giants to organize a day of action back in July. Fortunately, the proposal won’t proceed until the FCC gathers enough public feedback over the next few months. Pai has been using this period to sway the general public, specifically by providing investment data that reportedly indicate the economic harm that net neutrality rules have created – except, his use of the said data doesn’t necessarily establish causation and is rather misleading.

So, about that 9 percent drop…

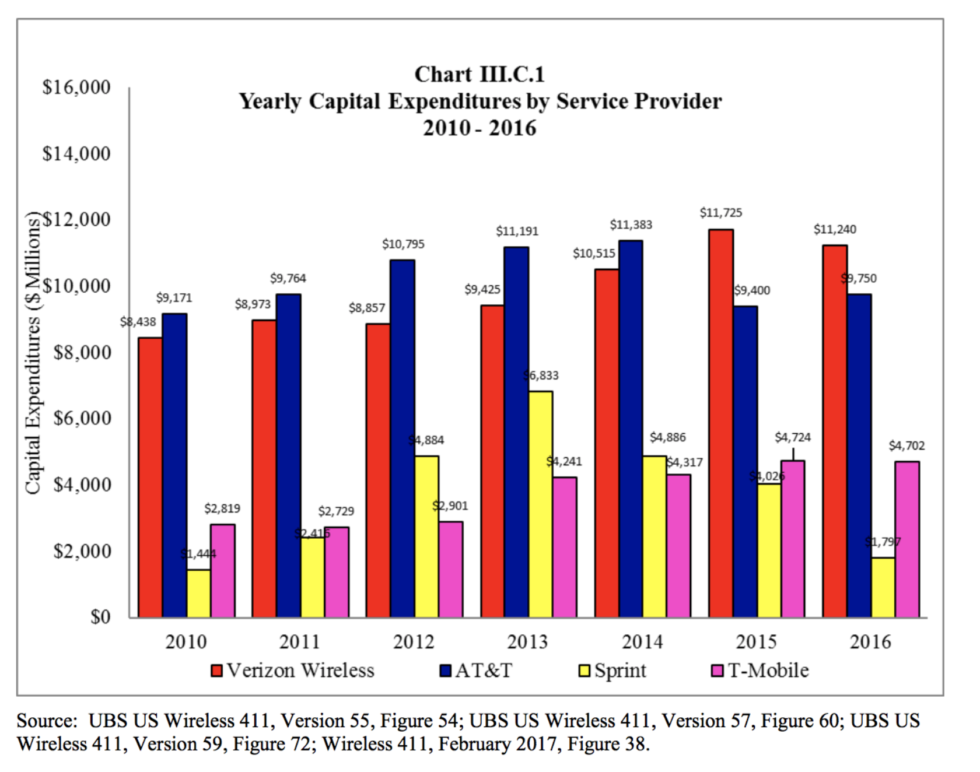

Pai’s argument for the repeal of net neutrality rules lies heavily within his economic argument: in particular, he has repeatedly cited investment data from wireless companies, which show that there was a 9 percent decrease in yearly capital expenditures by Verizon, AT&T, T-Mobile, and Sprint in 2016. Indeed, that’s a year after net neutrality was enacted, and Pai’s claim is, as you may have guessed, that these rules are dissuading companies from spending money.

However, there are a few problems with his argument. First, as Democrat FCC Commissioner Mignon Clyburn argues, 2016 was not the only year that the US saw a decline in investment from the four major carriers:

By highlighting a decrease in investment between 2015 and 2016, this section was clearly written to support the false narrative that the 2015 Open Internet Order deterred wireless carriers from investing in their networks… Despite my office’s request, this Report does not include data from the 19th, 18th, and 16th Competition Reports, which showed investment from all commercial wireless companies declined from $33.1 billion in 2013 to $30.9 billion in 2015. In case you missed it, those reports predated the 2015 Order. Also, despite my request, this report does not include CTIA’s investment data indicating that investment per consumer measurements declined from 2006 to 2009. Just in case you missed it again, that predates the 2015 and 2010 Open Internet Orders. These statistics demonstrate that there must be other factors, other than the Open Internet Orders, that account for why wireless carriers decreased their investment in their networks.

In 2010, the FCC approved a weaker set of net neutrality rules, which eventually came to an end in 2014. As Clyburn effectively indicates, investment dips have happened before 2010, despite there being no net neutrality rules, and wireless network investment actually rose shortly after the initial Open Internet Order in 2010. The investment then dipped again from 2013 to 2015, before the current net neutrality rules took effect.

In response to her criticism, the FCC included an edited chart in its Mobile Wireless Competition Report to include Verizon, AT&T, T-Mobile, and Sprint’s investment data from 2010 through 2016 (see above). Before Clyburn’s comment, the draft report only went back to 2013.

There are many reasons behind the slight fluctuations between years, but one primary explanation is the introduction of 4G LTE. As Ars Technica explains, AT&T’s comment further illustrates why minor variations from year to year are not an indication of declining competition:

There is no reason to expect capital expenditures to increase by the same amount year after year. Carriers spend a lot of money to expand or upgrade networks when a new generation of technology has been introduced “and then focus the next year on signing up customers and integrating those new facilities into their existing networks, and then make additional capital expenditures later, and so on.

Pai has essentially cherry-picked 2016 and 2016 only to prove his point, but seen within the overall trend, his ex post facto argument is simply fallacious. If anything, the investment data are an indication of the healthy competition that’s present among America’s wireless companies.

Pai has essentially cherry-picked 2016 and 2016 only to prove his point, but seen within the overall trend, his ex post facto argument is simply fallacious.

Another issue is causation – or the lack thereof. Given the variations in expenditures over the last six years, it’s hard to conclusively state that the dip in 2016 was caused by net neutrality rules. It may be that carriers are focusing on recruiting more customers before they invest in 5G technologies. It may be that infrastructure expansion has reached a plateau for most carriers. Who knows. In fact, even if the expenditures continued to grow from right up until 2015 and then suddenly decreased, there may be a third factor that could explain this phenomenon. In other words, Pai may be claiming that there is a causal relationship when it’s simply a spurious relationship.

What happens now?

It’s possible that Pai could ultimately decide against repealing net neutrality rules due to the enormous amount of opposition. It’s possible that Pai will try to move forward with his plans but be forced to stop due to legal issues. And of course, it’s possible that Pai will successfully gut net neutrality rules. If you disagree with Pai’s position, however, you can voice your opinion by going to the FCC’s website. Simply click the “+Express” button next to “Restoring Internet Freedom,” and fill out the form, expressing your support for net neutrality rules. You can find more instructions in our previous article.