Affiliate links on Android Authority may earn us a commission. Learn more.

Intel and Rockchip: Anatomy of a chip deal

If you can’t beat them, join them. That seems to be the bottom line in Intel’s strategic partnership with Fuzhou Rockchip Electronics Co. Ltd. It’s a tectonic shift on Intel’s part; the venerable silicon powerhouse has traditionally been focusing on premium computing devices that require the performance levels consistent with the Intel architecture.

Intel, which had kept the SoC development in-house so far, announced in May 2014 that it would join hands with Rockchip to co-develop low-cost system-on-chips (SoCs) for sub-$150 tablets. The Santa Clara, California–based chipmaker, stopping short of licensing its IP, would allow Rockchip to modify design around its x86 Atom core. The partnership doesn’t prevent Rockchip from using ARM processor cores, and there is no financial investment from Intel in Rockchip.

Still, there were more questions than answers, and soon the chip deal became a matter of intense speculation among technology business circles. There has been a lot of ambiguity surrounding this technology alliance, mostly because both Intel and Rockchip aren’t giving away much information except some minor product details.

So Android Authority takes a closer look at the tie-up between Intel and Rockchip from both sides of the fence and attempts to unwind the mystery around this technology liaison. What does this tech relationship stand for? What are the stakes for Intel and Rockchip, respectively? What is the end game? Android Authority sifts through the nitty gritty of this innovative setup in an attempt to find some of the answers.

What Intel Wants?

Intel, which has a history of setbacks in the mobile market, has adopted a novel strategy to break the deadlock and finally make some traction in the mobile industry. Rockchip, which shipped 40 million app processors for tablets in 2013, would bring Intel a better cost base and local ecosystem contacts. The middle-aged Intel would get deeper access to China’s high-volume tablet and smartphone manufacturers and design house through its Rockchip connection.

Another basic consideration for the top U.S. chip vendor is the proliferation of its x86 mobile ecosystem. Intel CEO Brian Krzanich believes that his new semiconductor partners in China—Rockchip and Spreadtrum Communications—lack resources to simultaneously build x86- and ARM-based SoCs. So, eventually, they could transition away from ARM ecosystem and switch to x86 SoC design platform. That sounds a bit optimistic given ARM’s near-ubiquitous presence in China’s silicon landscape and the role that ARM processor cores have played in enabling local chipmakers to create low-cost SoCs.

The view from Rockchip

Rockchip became famous by supplying cheap application processors to China’s white-box tablet market. Eventually, it began to serve budget SoCs to larger tablet brands in China and Taiwan. Then, in 2013, MediaTek entered the white-box market for tablets, and unlike Rockchip, which merely supplied application processors, MediaTek SoCs came integrated with baseband sockets. The follwing year, Rockchip joined hands with Intel to develop mobile SoCs using Intel’s Atom processor core and baseband technology.

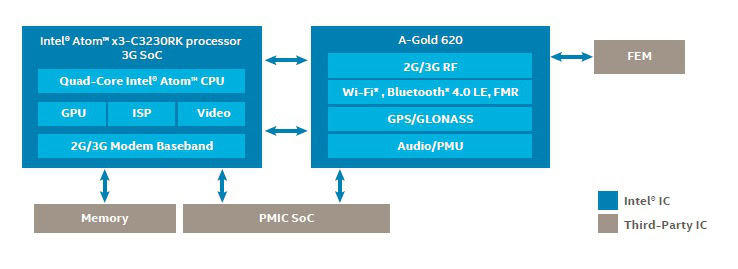

ARM has made application processor design relatively straightforward, but a cellular radio connectivity stack—also known as modem or baseband chip—is costly and hard to design. Rockchip has collaborated with the U.S. chip giant to develop an entry-level SoC—labeled as X3-C3230-RK—which comprises of a quad-core Atom application processor, Mali 400 MP4 graphics, and Intel’s 2G/3G/HSPA+ baseband. Apparently, access to 3G modem technology would significantly improve Rockchip’s competitiveness.

For a start, it has allowed Rockchip to make a foray into the high-volume smartphone business and has provided Intel with an ally in smartphone wars. Rockchip unveiled smartphones and tablets using Intel processors at the Hong Kong Electronics Fair being held on April 13-16, 2015. However, a closer look at this tie-up shows that Rockchip’s baseband project is merely a sweetener in the deal.

In the long run, what matters more to Rockchip is access to Intel’s prized IP, a rare commodity among China chipmakers. The tablets based on Rockchip SoCs generally have buggy software and quality issues. The example of successful smartphones likes Samsung Galaxy shows that user experience is crucial in a mobile product’s success. Apparently, Rockchip has realized the critical importance of user interface and other software features for its customized and turnkey SoC solutions.

Intel is also the only processor architecture company with its own fab. Rockchip might want to seize the initiative of working with Intel’s engineers and streamline its hardware, software and UI workflows with whatever access it gets to Intel’s cutting-edge chip technology. Intel is already providing technical support to design-houses such as Emdoor, Hampoo and Techvision, which are all Rockchip partners.

The end game

The common perception about Intel’s tie-up with Rockchip is that it’s a marriage of convenience, and before long, they could be facing each other as competitors. However, the scope of Intel’s liaison with China’s budget SoC maker could be deeper than jointly developing low-cost chips for tablets. The association between Intel and Rockchip has already transcended from tablets to smartphones.

The tricky Internet of Things (IoT) business could well be the next frontier, where Intel’s Quark processor is ready for the limelight with a complete ecosystem that spans from the edge to the data center. Then, there are partners like McAfee and Wind River, who could help Intel offer an interoperable, secure and scalable IoT platforms.

Intel lured chipmakers from China with a range of IoT-centric products and technologies at the Intel Developers Forum (IDF) held in Shenzhen, China in April this year. More importantly, Intel announced that the partnership with Rockchip will expand to IoT versions of x3 Atom SoCs. The mobile SoC business is all about volume and Rockchip has proven its volume merits in the tablet business. So Intel would most likely stick it out with Rockchip while eyeing China’s nascent IoT and wearable markets.

And that’s the embodiment of Rockchip’s unconventional hook-up with the world’s largest chipmaker. The Fuzhou–based SoC house would cultivate x86 designs in China’s vast electronics market while providing Intel access to its local network of device manufacturers and design houses. In return, Intel would give Rockchip a calibrated and calculated access to its IP and help China’s budget SoC supplier improve the quality of its chip designs.

Intel’s Senior Vice President Kirk Skaugen pointed out during his keynote at the IDF in Shenzhen how the multinational firms like General Motors and Volkswagen prospered by working with local partners in China. Apparently, Intel is in it for the long-haul, and its China-friendly image could favor it at a time when Qualcomm is at odds with the country’s technology establishment. Chipmakers in China are now more inclined toward innovation and Rochchip’s tie-up with the world’s largest silicon firm embodies China’s desire to nurture local technology industry.

Thank you for being part of our community. Read our Comment Policy before posting.