Affiliate links on Android Authority may earn us a commission. Learn more.

TrendForce anticipates first annual decline in Samsung smartphone shipments

October 14, 2015

Samsung may still be the biggest player in the smartphone market, but after years of annual growth, increasing competition and swings in market preferences are beginning to take their toll on the company’s sales figures. Market researcher TrendForce is now anticipating that Samsung will see its first year-over-year decline in handset shipments in 2015.

However, analysts are only expecting a decline of 1 percent year on year, leaving the company with a still substantial 323.5 million handsets expected to ship this year. According to TrendForce, it is not Samsung’s high-end smartphones that are seeing a major dip in sales, but rather the company’s mid and low-range efforts that losing market share to cost effective Chinese competitors.

“Samsung has lost much of its shares in the low-end to mid-range markets to Chinese competitors,” – TrendForce

Samsung doesn’t make it into the top 5 brands in China and fast growing markets, such as India, have become increasingly competitive and price sensitive, full of cost effective handsets produced either locally or in China. However, efforts like the Samsung Z1 have apparently seen some success.

This report is somewhat at odds with recently analysis from IBK Securities Co. in Seoul, which suggests that sub $200 devices have contributed to a smartphone shipment increase for the company in the third quarter. Perhaps Samsung is in the midst of refining its inexpensive smartphone strategy, which is only now beginning to pay off later in the year.

A negative sales trend is reflected in Samsung’s quarterly financial statements, which have seen falling revenues from the company’s mobile division. It is not all bad news for Samsung this year though. The company is expected to post an operating profit of 7.3 trillion won ($6.3 billion) for Q3 2015, an 80 percent increase over the previous year. This is partly due to a large increase in semiconductor sales and favorable exchange rates.

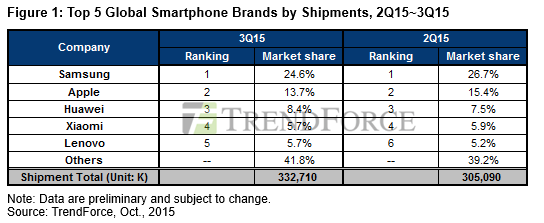

[related_videos title=”Samsung verses:” align=”right” type=”custom” videos=”647458,644809″]Looking at the broader industry, Samsung is still expected to remain the dominant manufacturer in the industry, with a 24.6 percent share of the market in the third quarter. Apple remains in second on 13.7 percent, down from 15.4 percent, while Chinese company’s HUAWEI, Xiaomi and Lenovo fill up the rest of the top 5.

Xiaomi continues to make gains this year, somewhere in the 15 percent region, but will apparently miss out on its target to sell 100 million devices in 2015. HUAWEI appears to be this year’s big success story, with a 40 percent growth in sales YoY securing the company third place in global market share table.

Overall, smartphone shipments are up a healthy 9 percent from the second quarter, due in part to the early introduction of some new flagship smartphones. However, worries about market saturation, downwards price pressure and a generally weak global economy are leaving some to doubt the market’s true strength, which may not pick up again until the mid-point of 2016.