Affiliate links on Android Authority may earn us a commission. Learn more.

Asian market turmoil: HTCand HUAWEI down, vivo, OPPO and ASUS on the rise

July 5, 2016

A new analysis of the Asian smartphone market shows that there are some major changes afoot. Big brands we’ve come to associate with dominating the Chinese market are on the wane while smaller upstarts are ascending rapidly. It was only two years ago that Xiaomi and Lenovo were the big names in China before they had their position usurped by the now ubiquitous Huawei in 2015.

Big trouble in little China

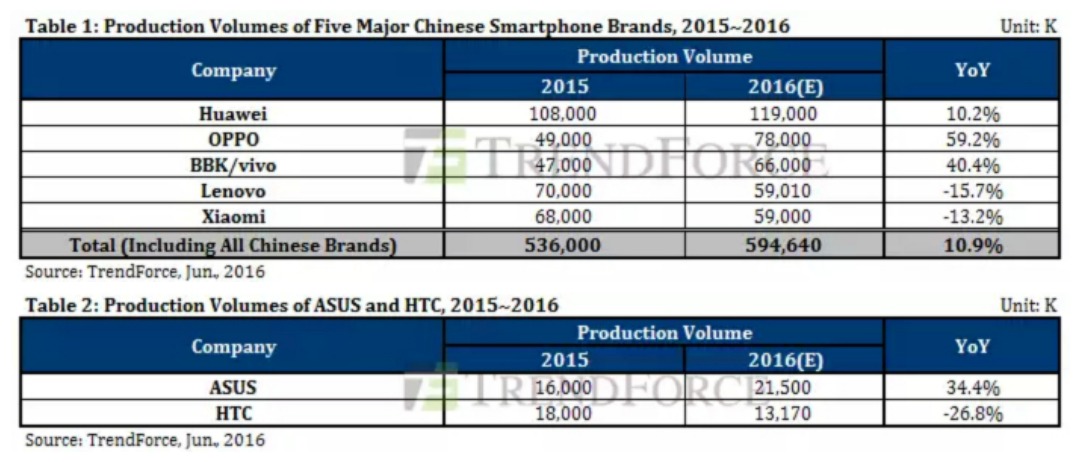

But this year HUAWEI looks to be in a little trouble. While still maintaining the number one spot in terms of production volume estimates (a loose indicator of sales success), HUAWEI’s dominance looks to be on the decline. Market analysts TrendForce have just downgraded HUAWEI’s production estimates for the year. This potentially puts the number one spot up for grabs next year as other OEMs ascend rapidly.

Just as HUAWEI is starting to plateau, smaller companies like Vivo and OPPO are on the rise. While HUAWEI’s predicted growth has been lowered to 10.2% year-on-year, OPPO has been estimated to grow by 59.2% and vivo by 40.4%. Xiaomi and Lenovo are expected to see negative growth in 2016, continuing their decline. Meanwhile, young upstart LeEco is enjoying massive growth of 300% year-on-year, even if its production volumes are still well below its more established competition.

LeEco is enjoying massive growth of 300% year-on-year, even if its production volumes are still well below its more established competition.

This rapid change of the status quo should give you an idea of just how cut-throat the Chinese market is. A company can go from the top spot one year to barely making the top five a couple of years later. The same goes for the Taiwanese market where one-time major player HTC will be highly unlikely to even make the top ten globally. But just as HTC’s star falls, Asus‘ is on the rise.

Asus is on the rise

In Taiwan, ASUS has assumed the number one spot from HTC, whose annual production volume estimates have dropped 26.8% year-over-year from 18 million units to just 13 million units. HTC’s flagship device, the HTC 10, is only expected to ship one million units this year, despite its positive critical and popular reception. While HTC will focus more on VR in the future, TrendForce claims HTC’s primary business is still smartphones.

The HTC10 is only expected to ship one million units this year, despite a positive critical and popular reception.

On the other hand, Asus’ dropping of Intel chipsets in favor of the Qualcomm Snapdragon range has helped the company topple HTCin Taiwan. ASUS’ annual production volume is projected to reach 21.5 million units, a year-on-year increase of 34.4%. At these rates of change, it doesn’t seem impossible that OPPO will take the number one spot in China from HUAWEI next year and HTC’s position will continue to dwindle in Taiwan.

Who is your favorite Chinese OEM? Does HTChave a future in mobile?