Affiliate links on Android Authority may earn us a commission. Learn more.

Flatline: Analysts halve 2016 global smartphone growth predictions

Published onSeptember 9, 2016

We all know that smartphone growth is slowing down worldwide. Smartphone ownership is nearing saturation point, new markets are thinning out, emerging markets are becoming more established and everyone is holding onto phones a lot longer because they’re just so darn good these days.

As if to underscore the steady plateauing of the mobile market, analysts have once again reduced forecasts for smartphone growth in 2016. The shocking part is that they’ve cut their predictions in half. As if that’s not bad enough, the growth rate itself is essentially flatlining.

Analysts have reduced global smartphone market growth estimates from an initial 3.4% to just 1.6%.

Analysts at IDC have reduced global smartphone market growth estimates in 2016 from an initial 3.4% to just 1.6%. The reduction is the second in three months. IDC’s Jitesh Ubrani explians the situation is because “growth in the smartphone market is quickly becoming reliant on replacing existing handsets rather than seeking new users.”

Ubrani also said that consumers in the U.S. and EU are becoming “increasingly comfortable with ‘good enough’ smartphones,” killing the constant urge for the latest and greatest.

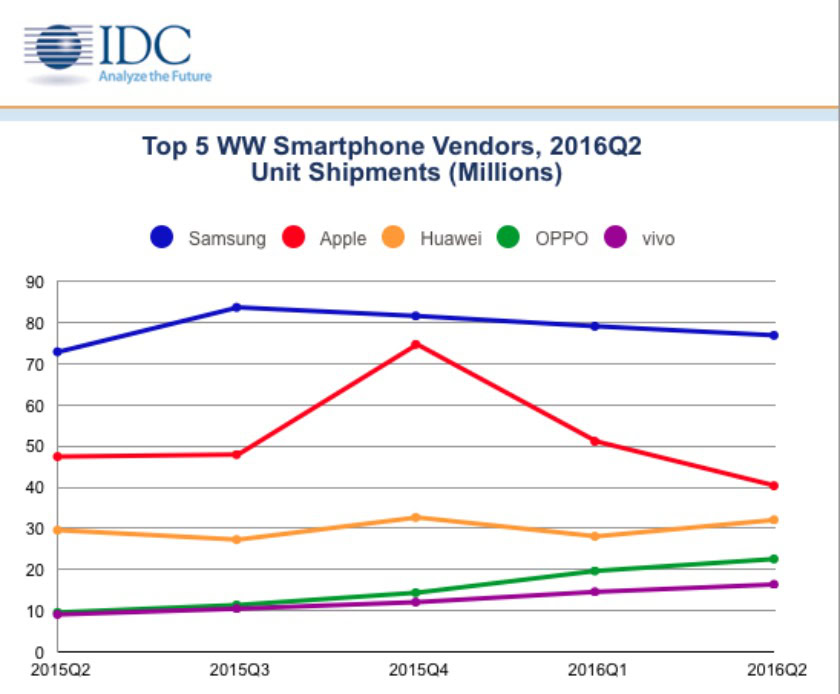

The maturing of developed markets comes at the same time that device manufacturers out of China including Huawei, OPPO and Vivo make their mark internationally with affordable and increasingly high-powered devices. This uprising is slowly eating away at the dominant positions held by Apple and Samsung.

Huawei's Richard Yu has publicly stated that HUAWEI plans to be number one in four to five years.

Samsung still holds the top spot though, with 22.4% market share, followed by Apple with 11.8% (as of Q2, 2016). But HUAWEI is coming on strong with 9.4%, with Richard Yu publicly stating HUAWEI plans to be number one “in four to five years”. Considering Apple’s steady decline and HUAWEI’s continual growth, we may even see HUAWEI take the number two spot in the next six months.

In order to stimulate growth, vendors are rolling out new enticements to encourage upgrades. As Ubrani notes, with “the launch of trade-in or buy-back programs from top vendors and telcos, the industry is aiming to spur early replacements and shorten lifecycles.”

Augmented and virtual reality (AR/VR) should also help stimulate upgrades in the next 12 to 18 months.

But it doesn’t just stop at smartphones: “upcoming innovations in augmented and virtual reality (AR/VR) should also help stimulate upgrades in the next 12 to 18 months,” he said.

Phablets (for want of a better term) are expected to grow in popularity from one quarter of the smartphone market to one third by 2020. Fortunately, prices for large-screen devices is expected to plummet in coming years, in opposition to regular-sized devices. As IDC’s Anthony Scarsella predicts:

Average selling prices (ASPs) for phablets are expected to reach $304 by 2020, down 27% from $419 in 2015, while regular smartphones (5.4 inches and smaller) are expected to drop only 12% ($264 from $232) during the same time frame.

On the OS front, nothing much has – or will – change, with Android representing over 85% of the smartphone market. Apple’s stance on the 3.5mm headphone jack and continued rumors of a major hardware refresh next year in celebration of the 10th anniversary of the iPhone are expected to contribute to a full year decline in iPhone shipments.

Who do you think will be number one in 5 years? Where will Apple and Samsung be?