Affiliate links on Android Authority may earn us a commission. Learn more.

Android Pay vs Apple Pay vs Samsung Pay: Pros and cons

Published onJune 8, 2018

When you go shopping this holiday season, many of you might be tempted to ditch using your credit cards, or even cash, in favor of one of the mobile payment systems that’s available for smartphones. Starting with Apple Pay, which launched in 2014, and joined later by rivals like Android Pay and Samsung Pay, it’s become more and more popular to pay with your smartphone, whether you are at a physical retail store or online at your favorite shopping web site.

But which online payment system is right for you, and what are the advantages and disadvantages of each system? In this article, we take a detailed look at Apple Pay, Android Pay and Samsung Pay, including their pros and cons, in order to give you a better idea of which of these mobile payment services may work best for you.

What is Apple Pay?

Apple Pay was first announced by company CEO Tim Cook as part of its iPhone 6 press event in September 2014. The service itself didn’t launch until October, with the iOS 8.1 update, and only worked at first on the iPhone 6 and iPhone 6 Plus. Later, the service expanded, in terms of native hardware support, to the first generation Apple Watch, and has since been included out of the box for all of the new iPhones, Apple Watches and recent editions of the company’s MacBook Pro laptop that use Touch ID. Apple Pay is also available on the company’s iPads, but only via an app, with no native hardware support. Owners of the company’s Mac PC products can also access it, via the Safari web browser.

In very basic terms, Apple Pay allows owners of the most recent iPhone or Apple Watch devices to add their own credit or debit cards, via the Wallet iOS app, for use in Apple Pay. Apple Pay also supports storage of gift cards and retailer rewards cards. Using those devices’ native NFC (Near-field Communication) hardware, you can take your iPhone or Apple Watch to any retail store that supports the service, and tap on its point-of-sale terminal to pay for any item at the store. You can also use Apple Pay in any app that also supports the service. Apple says that it uses “Device Account Numbers” for each credit or debit card that’s stored for Apple Pay use, and each transaction made with the service is also supposed to have its own security code. In theory, this means hackers should not be able to detect your credit or debit card numbers or bank accounts each time you use Apple Pay.

Pros

Because it got started first, in 2013, Apple got a head start on its two biggest rivals in terms of adding banks, retailers and country support for Apple Pay. Currently, the service is supported in over 20 countries and territories. making it the most widely supported mobile payment service. In a recent presentation during the Money20/20 business event in Las Vegas event, current Apple Pay head Jennifer Bailey said that just the United States, where it first launched in October 2014, Apple Pay support has expanded to over 50 percent of all retailers. All of the major banks in the US support Apple Pay for their credit and debit cards, and the number of smaller banks and credit unions that support the service also continues to grow.

In addition to the previously mentioned security features for Apple Pay, owners of iOS devices with Touch ID can add a further layer of privacy by only allowing Apple Pay to work when users put their fingerprint on the Touch ID sensor. In the recently launched iPhone X, that kind of security is replaced with that phone’s Face ID system, which uses the owners own face to confirm payments for Apple Pay.

Apple is also not done with adding features to Apple Pay. In the upcoming iOS 11.2 update, which is currently available as a beta release as of this writing, the company will launch Apple’s Pay Cash. Similar to other services like Venmo, Apple Pay Cash will allow users to send money to others, via the iMessage app. Those payments will be sent from your stored credit or debit card. The update will also let users receive money from others, which will go in the “Apple Pay Cash” card, a virtual card that’s accessible via iOS’s Wallet app.

Cons

The biggest issue with using Apple Pay is one that’s a familiar reason for most of Apple’s services. Apple Pay can only be use on the company own devices and apps. If you use an Android phone, you are out of luck. In addition, if you still use an older iPhone 5, iPhone 5s or iPhone 5c, Apple Pay will only work in retail stores if you also use an Apple Watch to connect to the phone and complete the payment.

In addition, if you use a smaller bank or credit union in the US, you may also not be able to add your credit or debit card yet to the Apple Pay service, although the company regularly added new banks on a pretty frequent basis. While 50 percent of all US retailers may support Apple Pay, that also means the other half does not.

What is Android Pay?

Google first revealed Android Pay its 2015 I/O developer conference, and it officially launched in September, 2015 in the US. Like Apple Pay, Android Pay is a mobile payment system, designed to let people purchase items and services both online and in the real world. It also uses NFC hardware on Android phones, and also stores credit and debit card information. A single from the NFC hardware from a compatible Android phone or Android Wear-based smartwatches to a retailer’s POS terminal completes the purchase. Android Pay can also be used online, with supported apps, and some retailers also support purchasing items online via Android Pay from Google’s Chrome web browser.

While it launched first in the US, it has since expanded its reach and is now available from banks and other financial institutions in a total of 17 countries It is scheduled to launch later in 2017 in South Korea and Slovakia. Earlier this year, the company launched a separate payment service, Google Tez, in the huge market of India. It works with the Indian government’s Unified Payments Interface (UPI) for mobile transactions.

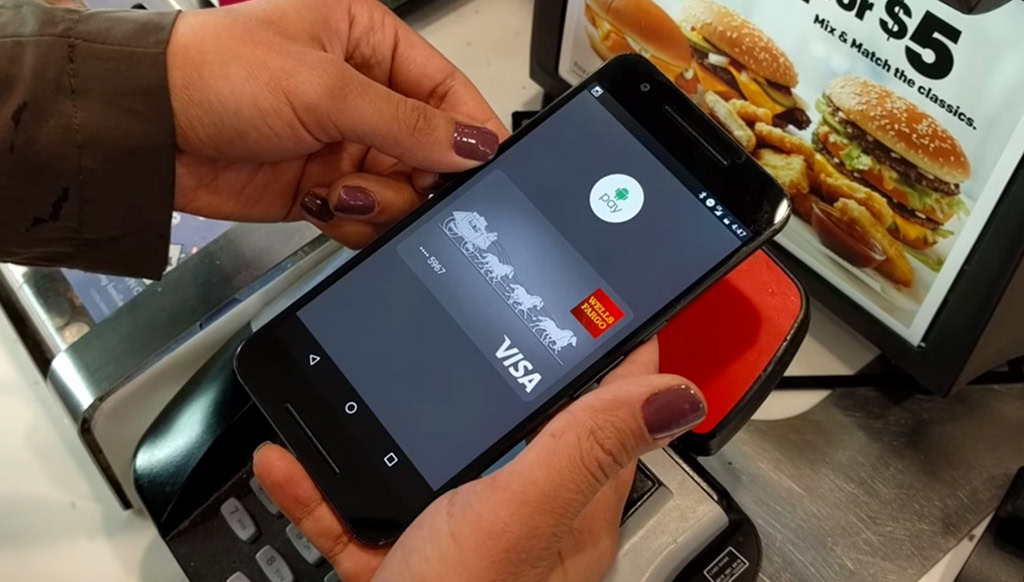

As with Apple Pay Android Pay uses near field communication (NFC) technology on supported Android smartphones and Android Wear watches. If their bank or credit union supports it, a user can add their credit or debit card information on their Android Pay account. When they want to pay for an item at a physical retail store, they take their phone or watch and place it near the retailer’s point-of-sale terminal. A signal send through NFC hardware send the payment information from the phone or watch to the POS terminal. Android Pay can also be used on some NFC-enabled ATMs so users can get cash money from their bank account, again without having to pull out their credit or debit card.

Again, as with Apple Pay, many Android apps support purchasing products with Android Pay as well. You can also store and use a number of gift cards and retailer rewards cards on your Android Pay account. For an additional amount of security, you can set up Android Pay so that, if your phone has a fingerprint scanner, it can be used to verify the payment within the app.

Pros

While Apple Pay is restricted to a limited number of devices, all made by Apple, Android Pay works on the vast majority of Android smartphones and Android Wear smartwatches, including ones from Google itself as well as third-party devices. Indeed, it works on any NFC-based phone that’s running Android as old as 4.4 KitKat. That means many more phones are supported for Android Pay in comparison to Apple Pay. In addition, Android Pay users can also type in a passcode to enable a payment if their phone does not have a fingerprint reader.

About 1.5 million retail locations in the US currently support Android Pay, with more being added all the time. Over 1,000 banks and credit units in the US, including all of the major ones, support Android Pay, and again, more of them are being added all the time.

Cons

As we have said, Android Pay expansion continues in more countries and banks. However, the sheer number of markets and banks that support Android Pay doesn’t not yet current match those of Apple Pay. Therefor, if you own both an Android Pay-based phone, and an iPhone that supports Apple Pay, the chances are better that your bank will have support for Apple Pay. If you live in Canada, that issue is a bigger consider as two of that country’s large banks, RBC and TD Bank, support Apple Pay but not Android Pay.

What is Samsung Pay?

Launched in 2015, around the same time as Android Pay, Samsung Pay is currently available to be used on a number of the company’s recent high end and mid-range Galaxy-based smartphones along with its Gear S2 and Gear S3 smartwatches. The biggest difference between Samsung Pay and its two rival services is that, in addition to supporting NFC-based terminals, users can also take their supported phone or watch and make payments on POS systems that use the older Magnetic Secure Transmission (MST) technology. This is the same tech that’s used on credit and debit cards, with their magnetic stripe on the back.

Samsung has put in a magnetic coil inside some of its recent Galaxy smartphones, and the field created by that coil, combined with the Samsung Pay app, can be used to transmit payment signals to normal credit and debit card terminals with the MST tech. In essence, Samsung Pay make those terminals think they are being accessed by a normal magnetic strip found in credit and debit cards. As with the other two systems, Samsung Pay transmits a unique number, rather than giving out your credit or debit card information, when it makes payments, keeping it secure.

Pros

The biggest advantage in using Samsung Pay is that users don’t have to rely on retailers having NFC-based POS terminals. They can use Samsung Pay at pretty much any store that has an old fashioned MTS-based credit or debit card reader. Thus, Samsung Pay users should, in theory, have many more options for using it in physical stores, especially during the holiday season.

Cons

As with Android Pay, Samsung Pay is currently supported by all of the major banks in the US, but the sheer number of banks and credit units it supports does not match that of Apple Pay, at least not yet. As with Android Pay, more countries and banks are added with Samsung Pay support on a regular basis. The biggest issue with Samsung Pay is that it only works with a certain number of Samsung-made Android smartphones, (all of which also support Android Pay) and just two of its smartwatches. Finally, Samsung Pay requried the use of a fingerprint scanner to complete translations, unlike Android Pay which can also use a passcode.

Conclusion

As you can see, the three major mobile payment systems all have their distinct features, along with their own advantages and disadvantages. Do you go with Apple Pay, with its greater reach of banks and markets, but limits on the number of devices? Do you pick Android Pay, with the widest number of devices supporting it but not as much support from banks. Do you pick Samsung Pay, which can be used by nearly any credit or debit card reader, but also suffers from a limited number of devices? Let us know which one you would want to use in the comments!