Affiliate links on Android Authority may earn us a commission. Learn more.

What does Apple Pay mean for Android?

Published onOctober 29, 2014

You could be forgiven for rolling your eyes when Apple revealed that it was all set to transform the world of mobile payments with incredible, groundbreaking innovations like NFC (near field communication) and a dedicated chip (or Secure Element) to store your details safely.

The idea of tapping your smartphone at a terminal to pay for something is not new. Google Wallet was released in the U.S. back in 2011 and it featured NFC and the Secure Element. A number of potential competitors have popped up since then including PayPal, Square, and Softcard.

Despite the availability of mobile payment systems the adoption by consumers has been slow. Apple may be behind the curve, but it’s not messing about. Apple Pay comes with a wide range of banks and businesses as partners, and since it uses industry standards there’s no reason that any of these new terminals won’t work with all the existing payment solutions on Android.

Why haven’t mobile payments taken off?

I was writing about the potential of NFC almost exactly two years ago. Mobile payments are just the highest profile use case for the technology, but the sticking points I identified back then haven’t changed.

- There’s a lot of competition in this space.

- There’s a chicken and egg situation with retailers in that they don’t want to spend on terminals until there’s a big enough user base, but the user base can’t grow without more places accepting mobile payments.

There’s a good reason that companies won’t work together and establish a single payment option and it’s nicely summed up by this prediction from Sandy Shen, research director at Gartner: “We expect global mobile transaction volume and value to average 35 percent annual growth between 2012 and 2017, and we are forecasting a market worth $721 billion with more than 450 million users by 2017.”

Whoever handles those payments can scrape off some kind of small percentage transaction fee, and that’s going to amount to a lot of money. So we end up with MasterCard’s PayPass, the Google Wallet, Apple Pay, Softcard (you can probably guess why they changed the name from Isis Wallet), and more. That’s just the NFC payment line-up; there are also alternatives like PayPal trying to stake a claim in this market.

MasterCard definitely wins the fingers-in-pies prize because it supports its own solution, PayPass, but it’s also onboard with Softcard, Google Wallet, and Apple Pay. Since there are established industry standards now for the tap and go technology, we should see more cross-over like this.

Apple Pay is also going to help deal with the second point as well, by encouraging all those retail partners announced at the reveal to install the necessary technology in their stores.

How is Apple Pay different?

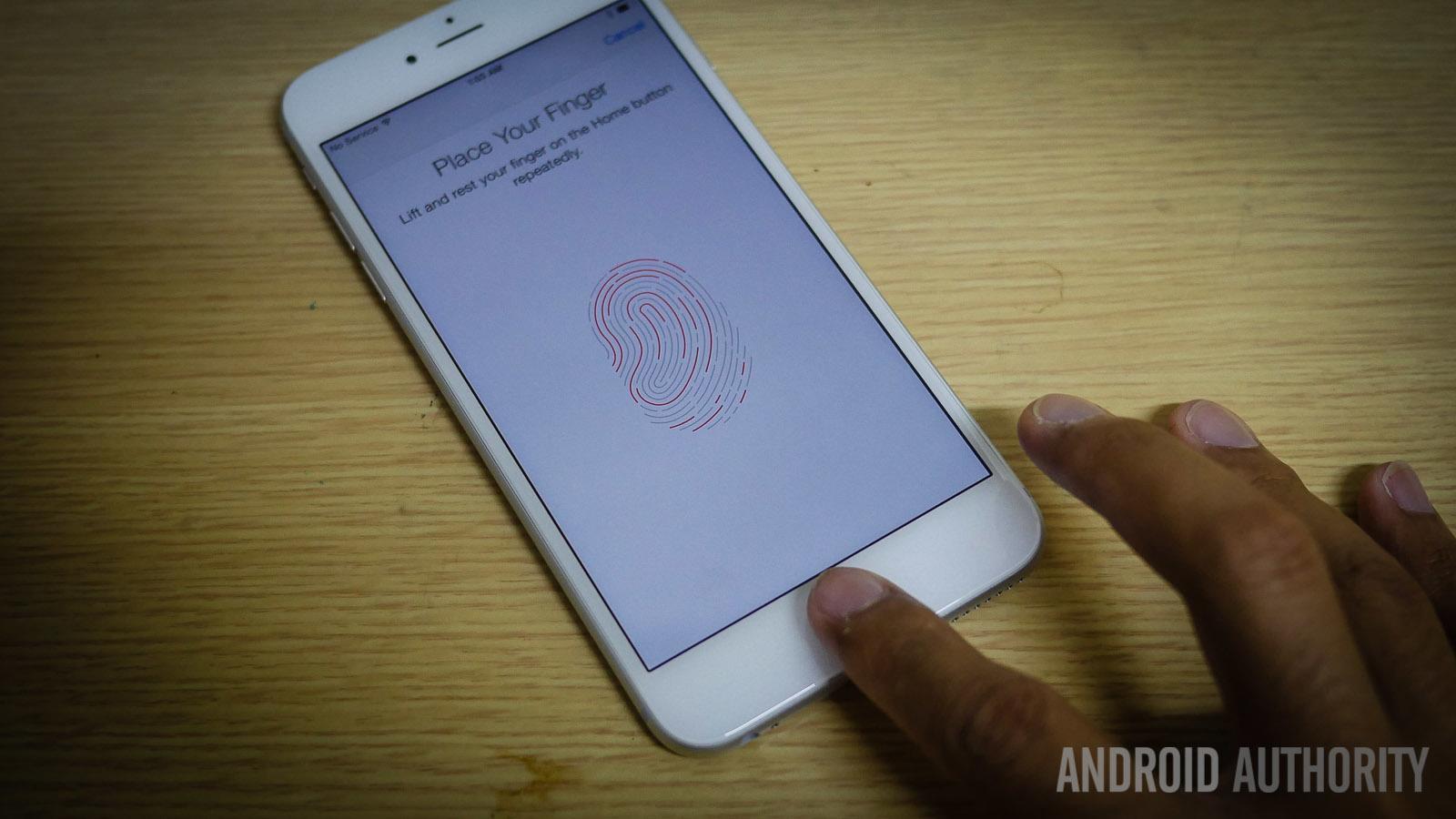

There’s one pretty important difference with Apple Pay that makes it more appealing and convenient as a solution. The Touch ID allows you to skip the PIN entry requirement and just rest your finger on the Home button. It’s really slick and quick, and it’s relatively secure.

Consider the improved transaction experience in-store at a terminal where you no longer have to enter a PIN, and at home shopping online where you don’t have to worry about passwords or card details.

I realize that Samsung introduced this with the Galaxy S5 where you can scan your fingerprint for PayPal payments, but Verizon blocked it and the functionality doesn’t extend to things like Google Wallet for NFC payments. It also just isn’t as slick as Touch ID, which doesn’t require a swipe motion. Samsung has made improvements with the Note 4, but it needs to do more to tie mobile payments to the finger scanner and match Apple’s offering.

The power of marketing

How many of you actually use Google Wallet? Are you aware of all the places that accept it? The truth is that Google didn’t throw a lot of weight behind it. It’s also only available in the U.S. in the mobile payment app form. The lack of a wider roll out more than three years after release says a lot.

A new technology like this, that requires consumer trust, needs to be marketed heavily. You have to reassure people that their details are safe, that the system works, and that it will offer a real advantage. None of the OEMs really got behind it either.

It’s easier for Apple to promote something like this; it doesn’t even need to set aside a much bigger marketing budget because it has big name partners onboard with a vested interest in advertising Apple Pay support. It also has one product line and it can include Apple Pay as another feature on the list for all of its ads, and it generates a huge amount of news coverage whenever it does something new. Mobile payments are old news, but look at the new wave of interest in the press because Apple has made a move.

Apple Pay will also only be available in the U.S. to begin with, but I bet Apple is quick to roll it out internationally where it can steal a march on Google.

A real wallet replacement?

There are still issues with mobile payments and the idea that your smartphone can really replace your wallet simply won’t fly with a lot of people. What happens when the battery dies? Support is far from universal. The advantage over plastic is arguably limited.

But as more and more places begin to support mobile payments as an option, you can be sure that adoption will grow. It looks like Google has squandered its early lead in the mobile payment space, but the fact that Apple would never allow something like Apple Pay to work cross-platform, ensures that Google and others can take advantage of the renewed interest it generates.

What do you think? Do you use NFC for mobile payments? Would you like to? What’s good and bad about the experience? What would tempt you to jump onboard? Hit the comments and tell us.