Affiliate links on Android Authority may earn us a commission. Learn more.

10 best expense tracker apps for Android

Published onDecember 10, 2021

Expense tracking is an important life skill. Self-employed people especially need to keep track of expenses for tax season. Even normal people can benefit from a good budget. Luckily, there’s nearly an endless number of ways to track your expenses. Your bank app can help, but there are other apps specifically for this purpose. Whether it’s keeping the IRS off your back or just trying to save up, here are the best expense tracking apps for Android to help.

The best expense tracker apps for Android

AndroMoney

Price: Free / $3.99

AndroMoney is an excellent, albeit simple expense tracker. You can keep tabs on multiple accounts, backup your stuff over the cloud, and various ways to view your spending statistics. The app keeps it simple by not having a lot of extra stuff that people generally don’t use. You input your accounts, add in your expenditures, and see what you spent money on over the course of a year.

We also like that the premium version is a single price and not a subscription, a boon to people trying to spend less money.

EveryDollar

Price: Free / $129.99 per year

Every Dollar is another decent budgeting and expense tracker app. The app lets you create custom monthly budgets, track your expenditures, set custom reminders to pay your bills, and do various things like that. The app has a simple layout that’s mostly easy to use, at least after you get everything set up.

It leans a bit more toward budgeting rather than expenditures, but it’s certainly helpful if you’re keeping track of the books for independent contractors.

Expensify

Price: Free / $5-$9 per user per month

Expensify is another excellent app for managing business expenses specifically. The app includes multiple ways to track your business spending, good basic features like receipt scanning, and other stuff like that. It was recently updated in 2021 with some fresh UI elements, although long-time users do say it’s a little more difficult to get around the app. Regardless, the app was custom-built for expense tracking.

The free version should work fine for most folks. The premium subscription is mostly for enterprise use.

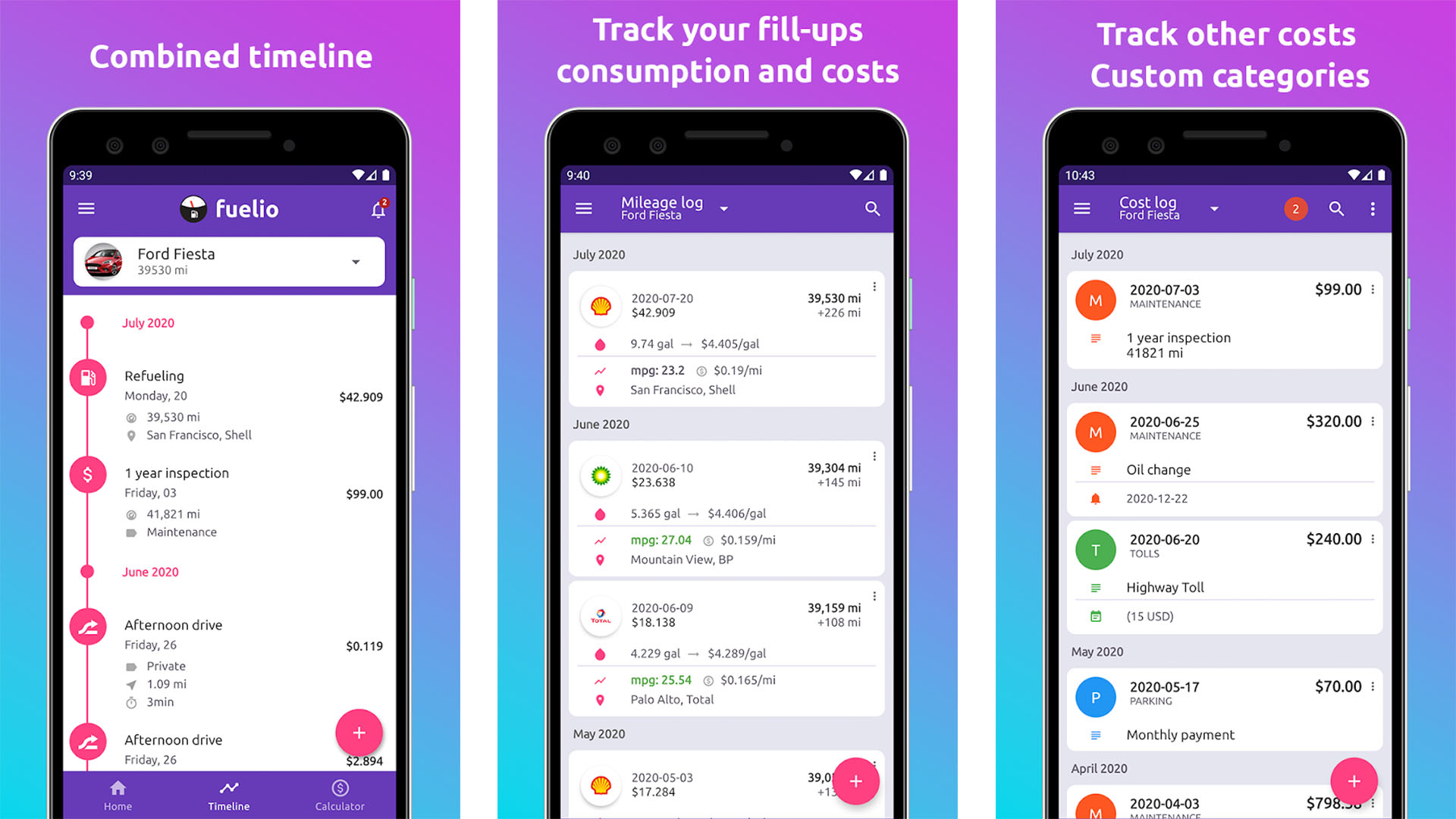

Fuelio

Price: Free

A lot of folks drive for work and Fuelio can help with that. It’s a gas and mileage log where you can easily input how far you drove and how much gas it cost you. It can also help you find nearby gas stations and cheaper gas. The app uses GPS to keep track of your distance traveled. It also works with bi-fuel vehicles.

You can back up your data on Dropbox or Google Drive, get reminders for things like odometer counts, and more. Drivers should definitely check this one out.

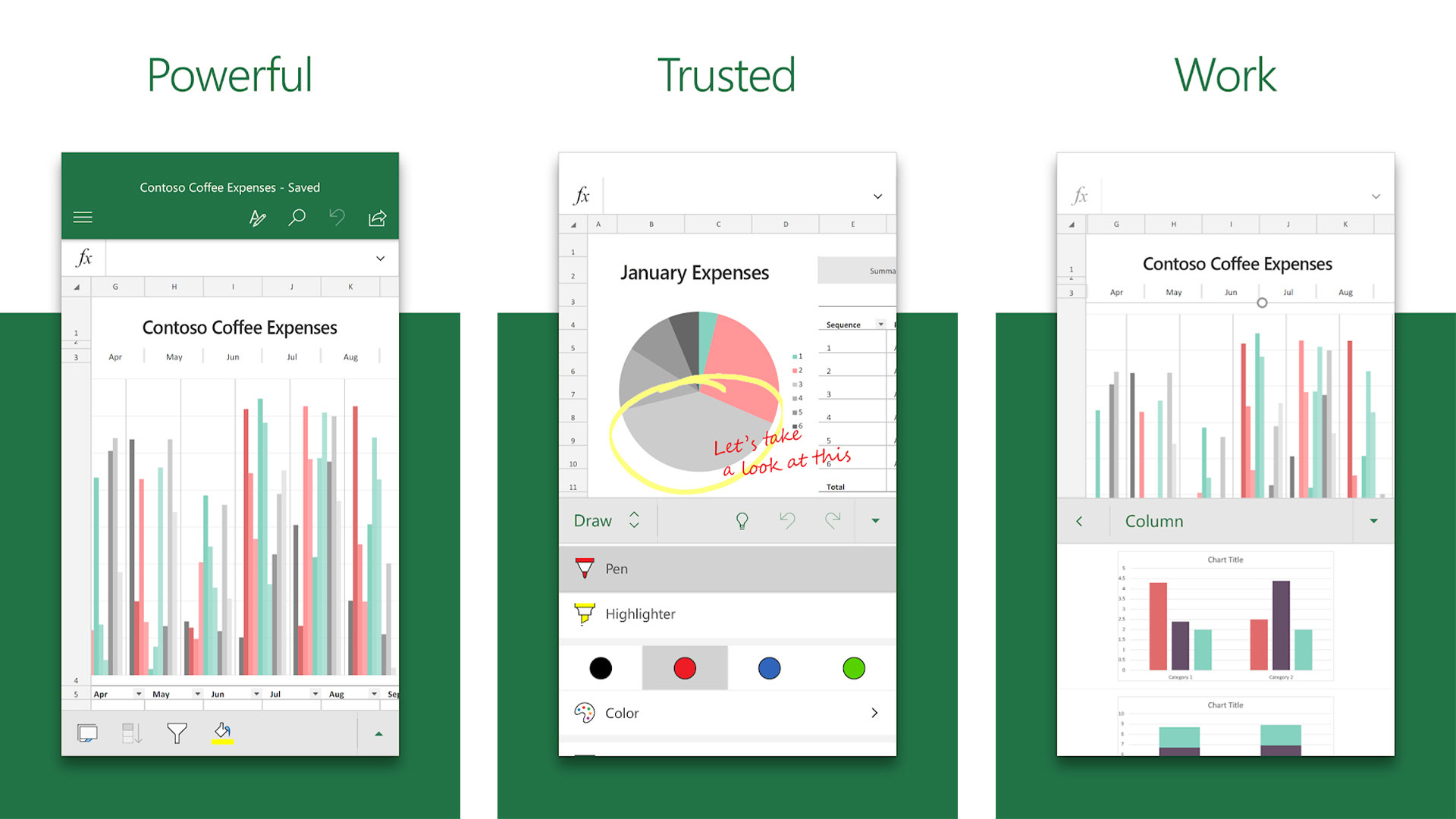

Microsoft Excel (or similar apps)

Price: Free / $6.99 per month / $69.99 per year

Those looking for something simple can use the good old spreadsheet approach. You simply configure your spreadsheet and add all of the various items you need. I personally use a method like this for my business expenditures as a tech blogger and it works fairly well as long as you remember to keep up with it.

We linked Microsoft Excel because it’s the most recognizable one, but Google Drive’s Sheets function works just as well in most cases. You can store both in the cloud and edit them there so you never need to worry about losing your data. For the most part, both options are free.

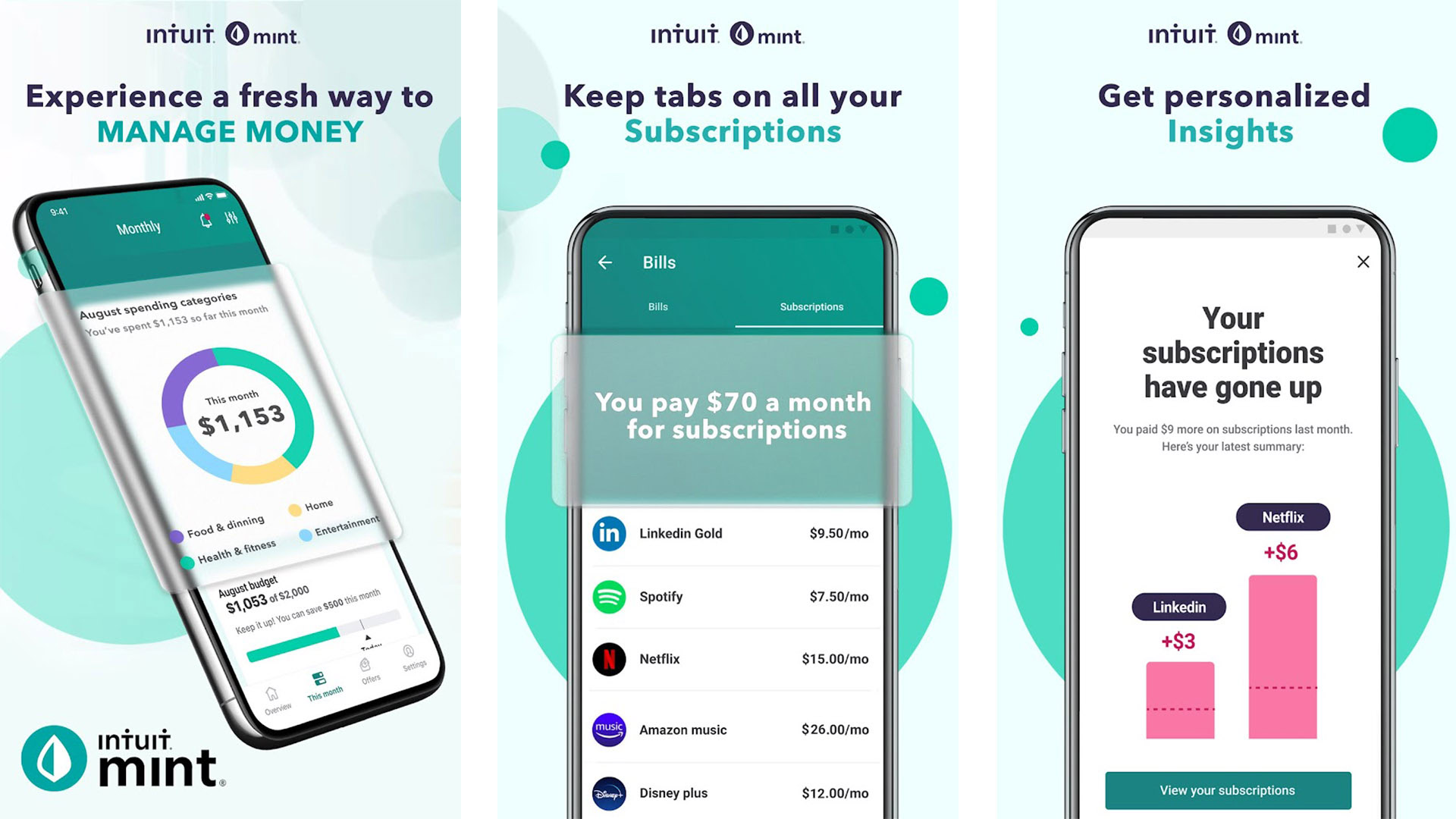

Mint

Price: Free / $0.99

Mint is one of the biggest names in expense tracking and budgeting. The app lets you track your transactions across all of your accounts, monitor your expenses, and even keep track of your investment accounts. There’s also support for cryptocurrency. It’s a decent all-in-one spot for all of those things.

The one downside is how Mint keeps changing its UI. It’s very clunky to use even after you get used to it. The pros outweigh the cons, but the continued complexity added to the app keeps it from being the slam dunk offering it once was.

Monefy

Price: Free / $2.49

Monefy is another financial organizer app that works quite well. It takes a more manual approach where you add records every time you spend money. Thus, you can more easily keep track of only some types of expenses if you want to go that route.

Some other features include Google Drive and Dropbox support, multi-currency support, a decent budget tracker, and the ability to collaborate with another person. It’s simple enough to be effective, but powerful enough to be useful.

Money Lover

Price: Free / $34.99

Money Lover is a budgeting app with some powerful features. You can connect your various accounts to the app, connect your bills to the app, and then automate your bill paying. That makes life easier just on the face of it. Some other features include an expense tracker with a nifty pie chart, categories so you can keep track of business stuff, and a decently simple UI.

The premium version unlocks a bunch of stuff and is rather pricy, but it does got on sale fairly frequently so we’d recommend waiting for a sale.

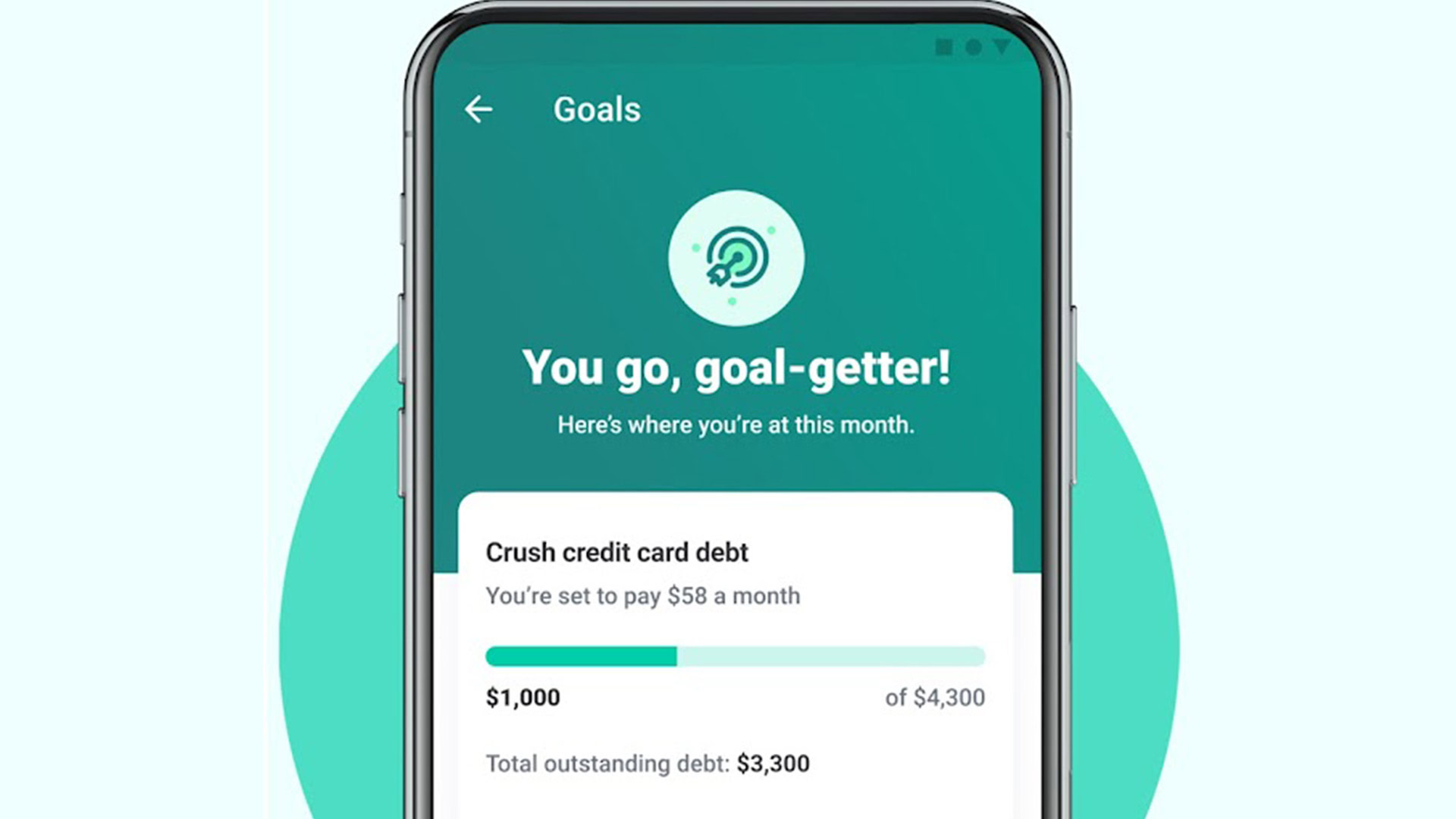

Wallet

Price: Free / $34.99

Wallet is a good finance manager. It’s built to help people save money, manage expenses, and plan for the future. The premise of this one is to get a lot of the extras out of the way, so you can set clear goals in regard to your finances. The app connects to your bank and automatically syncs with it.

You can create budgets, view reports, check out planned payments, and share the account with other people. It can also track receipts and export to CSV, XLS, and PDF so it’s also perfectly usable, come tax time.

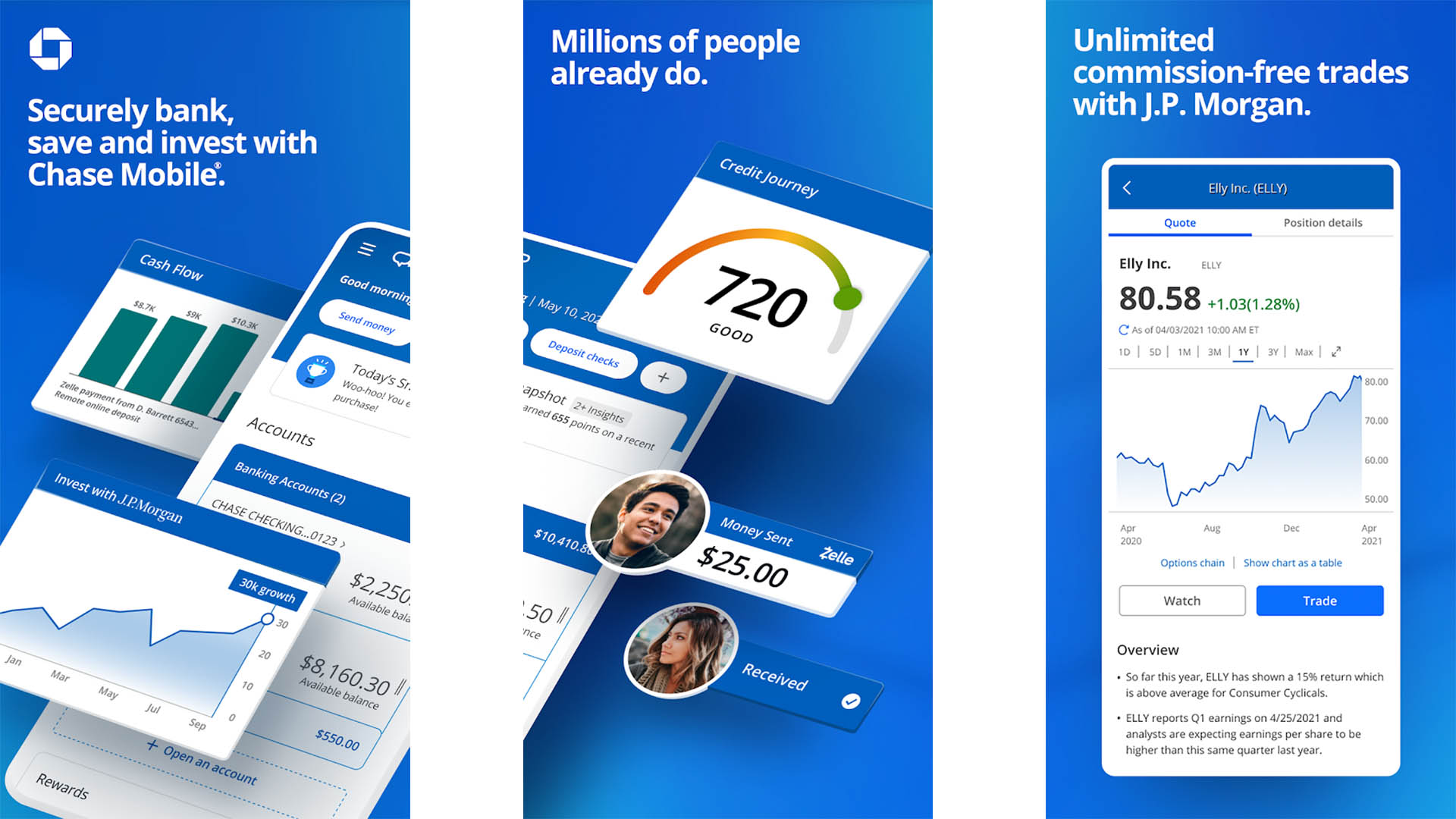

Your banking app

Price: Free

Your banking app may have the features you’re looking for depending on the bank. It obviously shows you how much money you have, your recent transactions, and you’ll need bank statements for a variety of things like car loans. Some banks include things like daily insights into your spending, budget tracking, and you can even track expenses on some apps.

Your bank probably won’t do it as well as one of the others listed, but if your needs are simple and your bank is equipped to help, it’s worth checking first to save yourself time and money.

If we missed any great expense tracker apps, tell us about them in the comments. You can also click here to check out our latest Android app and game lists.