Affiliate links on Android Authority may earn us a commission. Learn more.

10 best Robinhood alternatives and 5 other options to consider

Published onFebruary 18, 2022

Robinhood changed the face of investing, as it was one of the pioneers of the $0 commissions rule that most brokerages follow now. Not only that, the app is insanely easy to use, easy to access, and it gets people into a complicated thing at a pace that works for a lot of people. Unfortunately, it’s not all good. Robinhood lets beginners do things they shouldn’t be able to do without better knowledge such as trading options. Plus, with the whole GameStop controversy, Robinhood cost a lot of people money by restricting dozens of stocks. This tanked public opinion of the app and many people want to leave. We can help with the best Robinhood alternatives to try.

Also, the above and below information is not financial advice and is meant for informational purposes only. We are not drawing affiliate or advertising revenue from any of the services listed or discussed here.

The best Robinhood alternatives on Android

What made Robinhood good?

There is a reason why millions of people flocked to Robinhood to begin with. The company shaved away a lot of the complicated parts of stock trading to make it a lot easier for beginners. In fact, Robinhood is still among the most beginner-friendly stock brokers available anywhere. You can trade stocks quickly and easily without needing to know the ins and outs of trading stocks. Unfortunately, that approach is a double-edged sword. People trade stocks with ease on Robinhood but don’t really know how it works. That can cause all sorts of problems, especially if users get into things like options.

There is more to Robinhood than just ease of use. It lets you trade cryptocurrency, buy fractional shares, and it shows you big, sexy graphs so you can see your gains and losses easily. It also live streams quote prices all day (before, during, and after market hours), it let you trade stocks immediately after a deposit, and it strips away a lot of the rigamarole of stock trading to make the experience more enjoyable. Some people believe the gamification of stock trading is a bad thing, but that’s one of many opinions on the topic. Believe it or not, the app’s design and features are quite difficult to find elsewhere.

Finally, a few minor details. Robinhood charges you $75 to transfer your account to another brokerage so prepare yourself for that. Additionally, with the sheer volume of people switching away from Robinhood, a lot of brokerages are having problems with the sudden influx of new customers. Such problems include occasional server lag, long hold times for customer service phone calls or chats, and inflated account transfer wait times. All brokerages worth switching to are having these issues, so bear with them as they deal with this massive exodus of people.

Best overall: Fidelity

Price: Free / Varies

Fidelity has a very strong track record. It has some of the best customer service of any service on this list. Plus, it was one of the few brokerages not at all affected by the GameStop controversy. It lets you trade the usual stocks but also has a ton of options for retirement plans and other such things. The desktop app is one of the top two or three best in the industry. Plus, the customer service is very patient with explaining all the rules that Robinhood didn’t.

The mobile app is also pretty decent. It has a traditional brokerage experience, but Fidelity has been working hard on a beta version that is simpler to use and competes more favorably in terms of ease of use with apps like Robinhood.

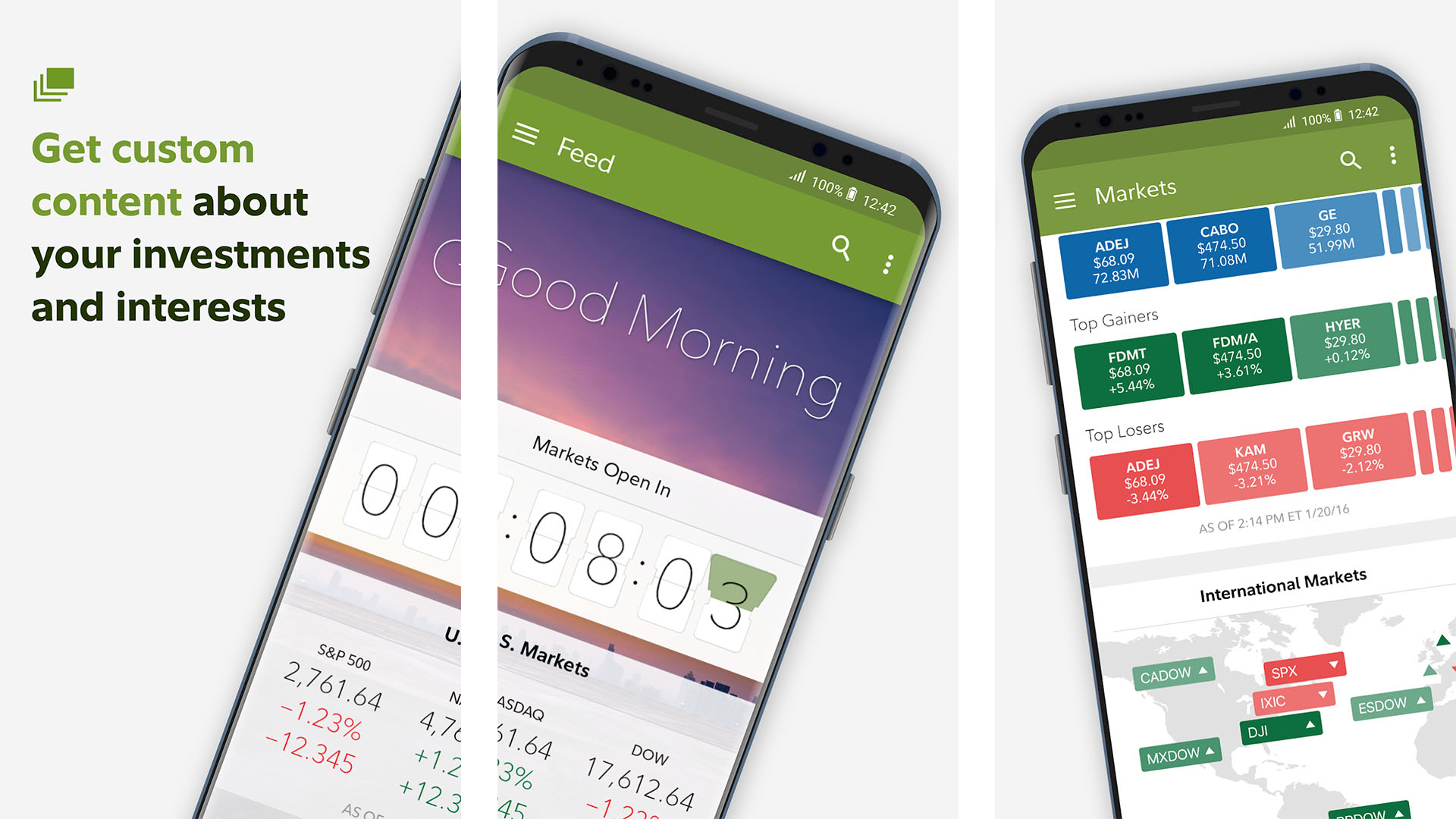

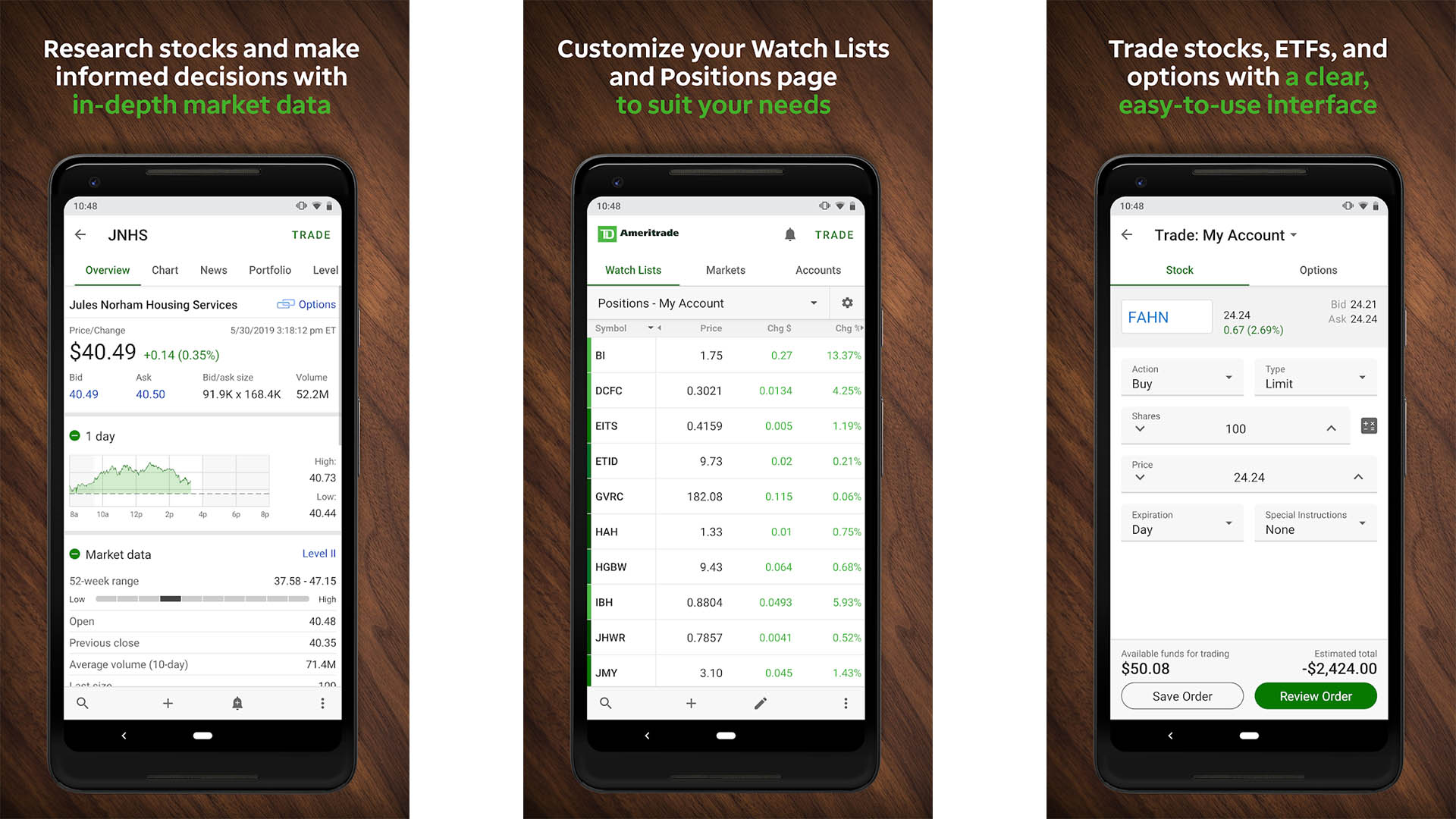

Most hardcore: TD Ameritrade

Price: Free / Varies

TD Ameritrade is right up there with Fidelity as one of the best Robinhood alternatives. It did have some restrictions, but not nearly as many nor for nearly as long. Ameritrade has two different apps. The first is the base Ameritrade app. It’s relatively beginner-friendly and easy enough to set up without a ton of assistance. It works well enough, although we did note some server issues during heavy trading days. Ameritrade’s ace is its Think or Swim platform. The desktop version of the app is right up there with Fidelity as a top two or three option. The mobile app gives you more information than you know what to do with until you become well-versed in the stock market scene. Think or Swim is much, much harder to set up compared to Ameritrade’s main app, but it is so much more powerful. Charles Schwab owns Ameritrade so we’re unsure of how that merger is going to play out long term. Like Fidelity, Ameritrade doesn’t offer cryptocurrency trading right now.

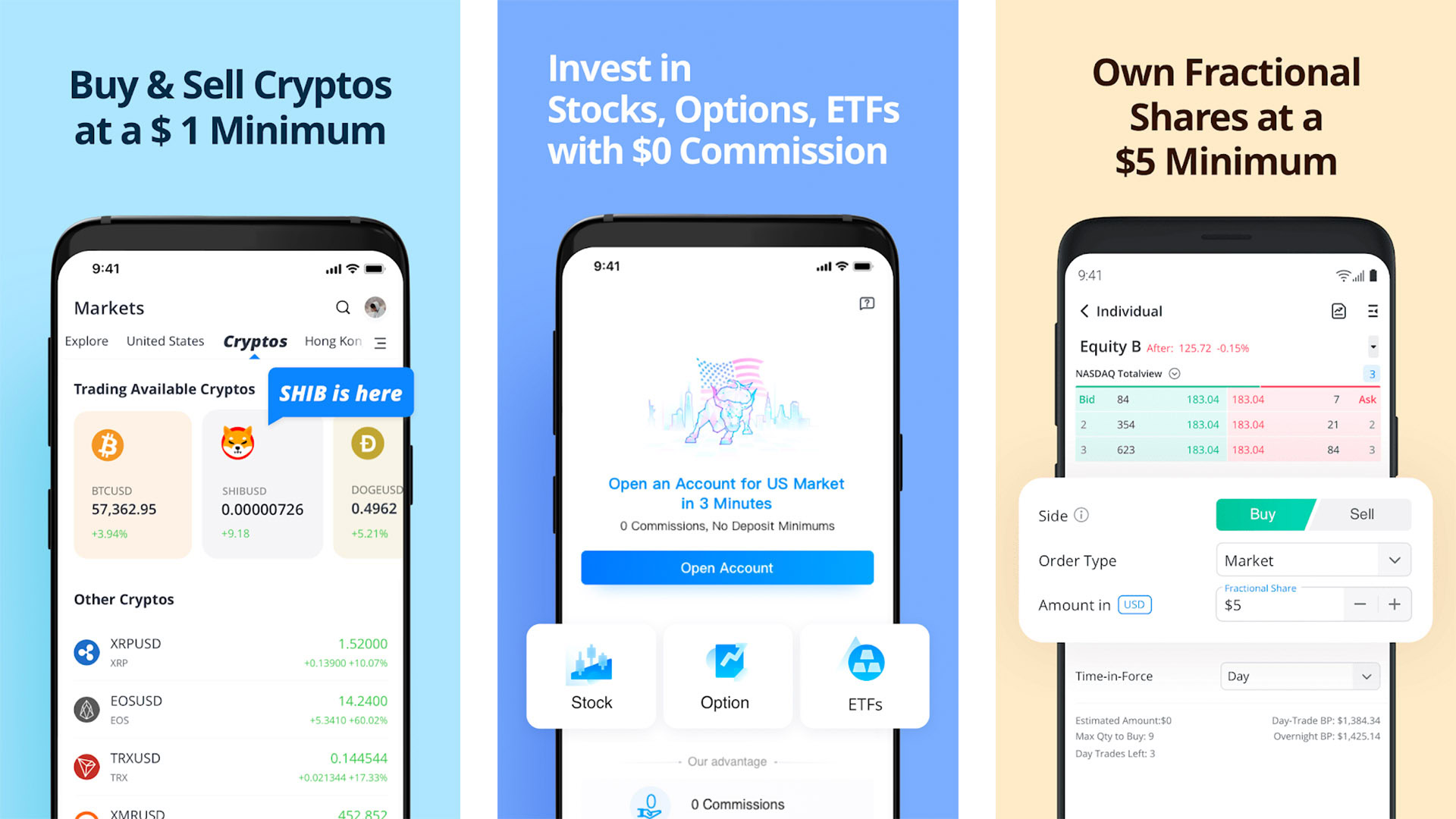

Closest Robinhood alternative: Webull

Price: Free / Varies

Webull is one of the closest Robinhood alternatives on the list. It does almost all of the same things. You can trade cryptocurrency, view real-time quotes, and it has an instant settlement feature so you can trade stocks immediately after a transfer. Webull even has a subscription with stuff like Level 2 information just like Robinhood. The only real difference between this and Robinhood is the slightly more complicated UI and the lack of fractional shares. A lot of folks switched to Webull during the GameStop issue, despite Webull also restricting trades on it for a short period of time. It even offers free stocks upon signing up like Robinhood. This is about as close to the experience as you can get.

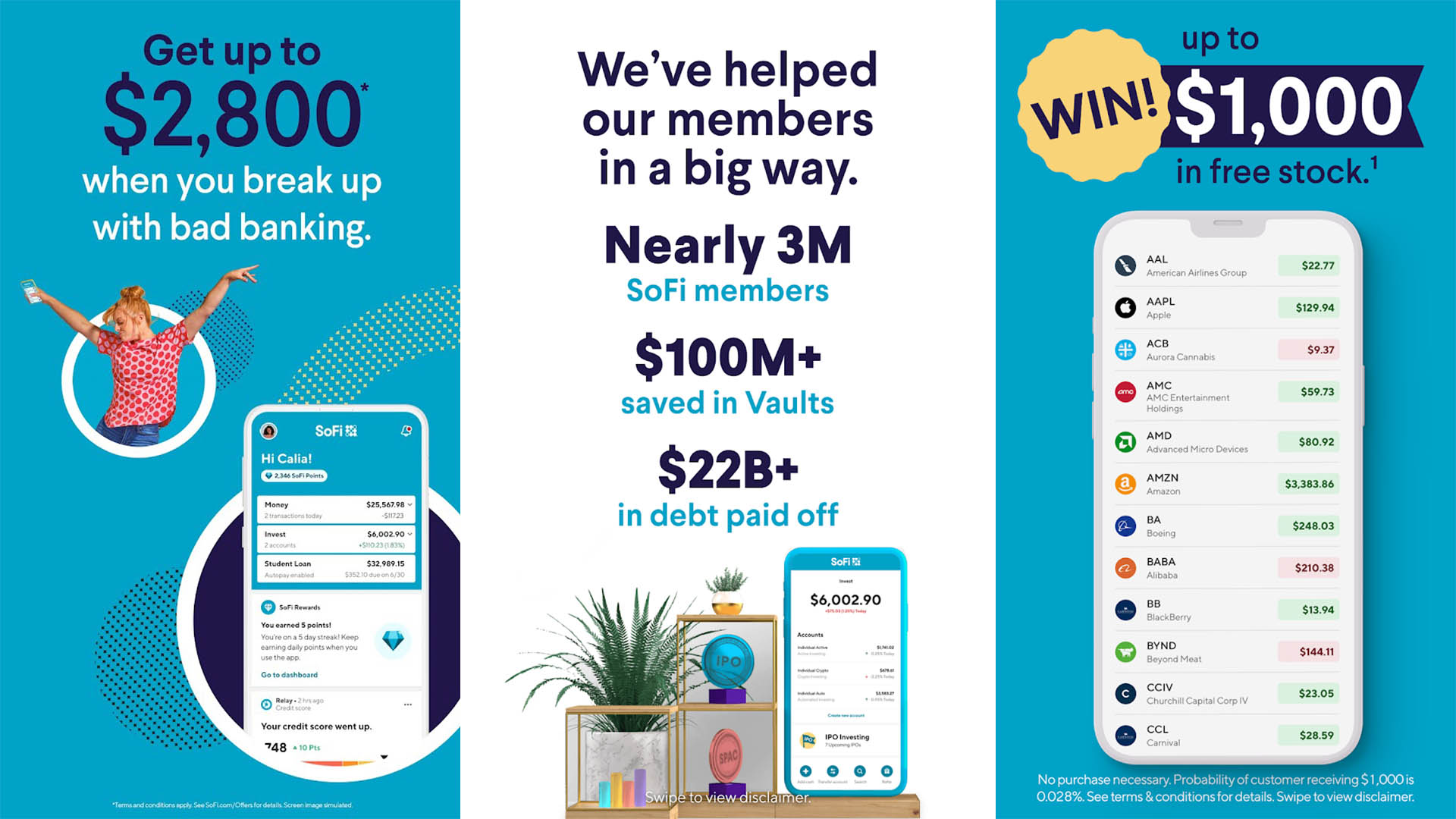

Second closest: SoFi

Price: Free / Varies

SoFi is one of the newest Robinhood alternatives on the list. Frequent Android Authority readers may recognize the company as the one sourcing Samsung’s debit card. The investment side of things are pretty decent for beginners, although not quite as good as Webull. It offers fast trading, cyrpocurrency support, and a simple UI while also offering stuff that traditional brokers offer like an optional full-service bank account. In fact, it’s basically just as good as Webull and Robinhood at just about everything. The only thing I didn’t like is the lack of tools. For instance, SoFi doesn’t support stop orders as of the time of this writing. We assume they will eventually, though, so it’s only a temporary problem. SoFi is otherwise pretty good.

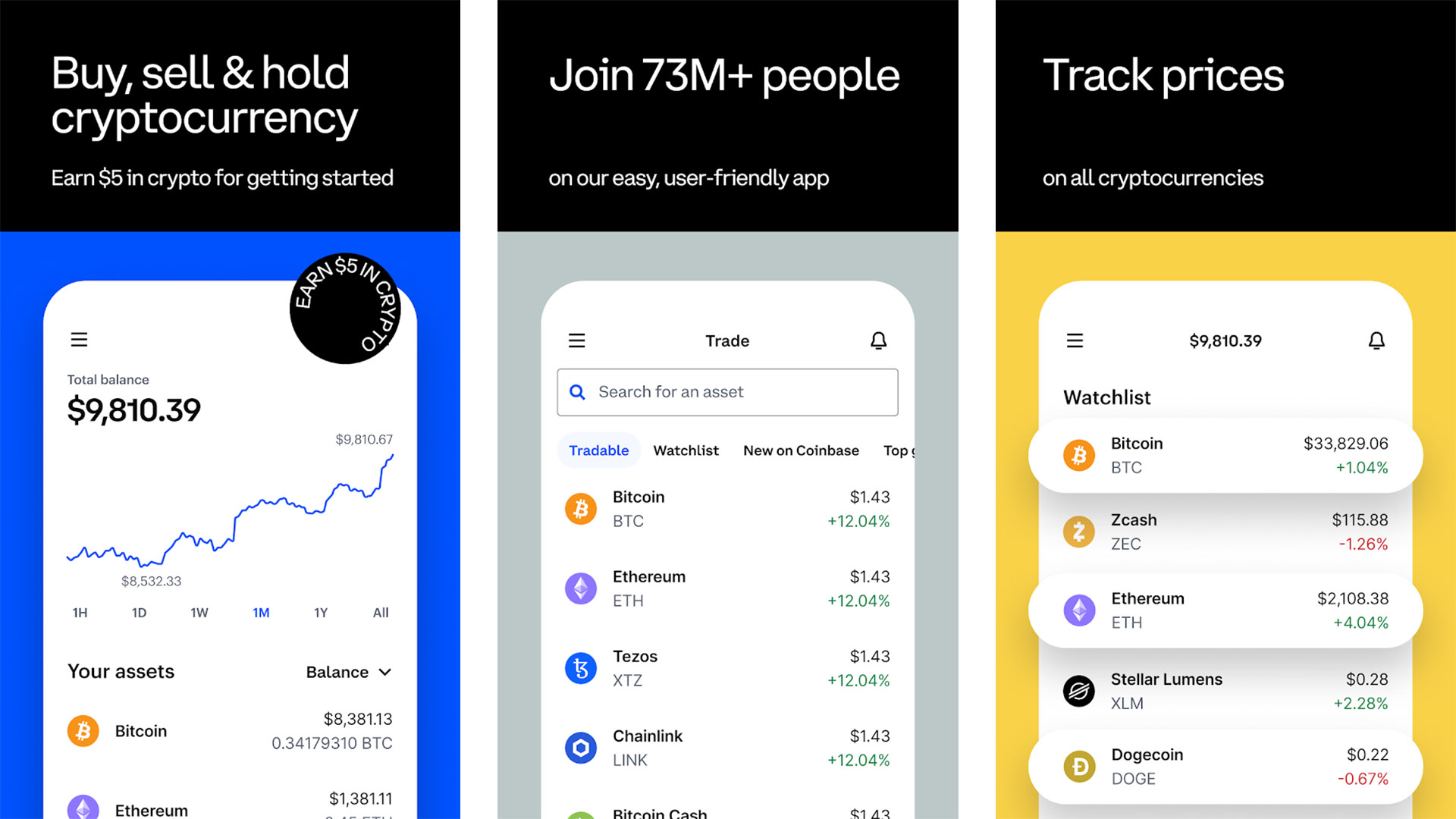

For trading crypto: Coinbase

Price: Free / Varies

Coinbase doesn’t actually let you trade stocks, but instead focuses on buying and selling cryptocurrency. A lot of people who switch to a brokerage like Fidelity or Ameritrade also pick up Coinbase so they can continue buying cryptocurrency as well. Coinbase has a very good app for it. There is a clean layout, a clear listing of your assets, and it supports a variety of different currencies. You also get some educational tools and other stuff. The app is far from perfect and there is a history of server issues and price discrepancies, but it’s better than most cryptocurrency trading apps.

Also consider: Charles Schwab

Price: Free / Varies

Charles Schwab is one of the big four when it comes to brokerages. It purchased Ameritrade and it’s definitely one of the most stable Robinhood alternatives. It has a very good website and a very good desktop app. Charles Schwab has two mobile apps. Both of them actually do work pretty well but both suffer from inefficient UIs that are hard to navigate at first. We certainly hope they take a page of Ameritrade’s and Fidelity’s notes and work to improve app usability in the future. It did limit GameStop trading just like Ameritrade but not for very long. There are fractional shares here but it’s not as robust as some competitors. Finally, Charles Schwab doesn’t include cryptocurrency. It’s still very good, but it could be better.

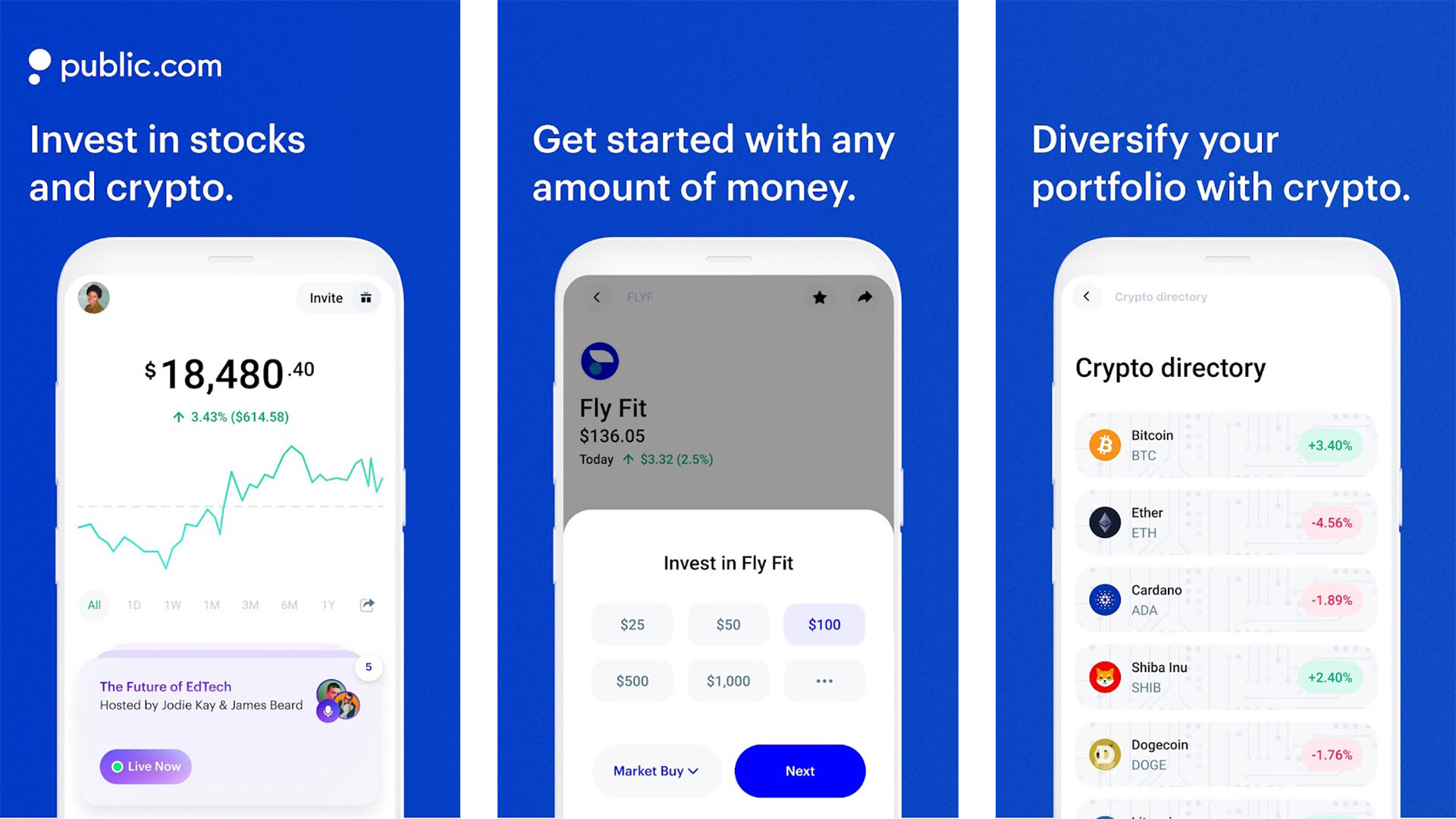

The newest start-up: Public

Price: Free / Varies

Public is one of the newest trading platforms on the list and one of the better Robinhood alternatives. It’s easy enough to sign up, transfer money, and trade stocks. The app features fractional shares (or slices), a mobile-first experience, and a colorful UI. It tries to use the same philosophy as Robinhood with things like themes and stuff like that. Plus, it has a better social element than many of its competitors. This one is still new and fleshing itself out so we might recommend Webull or SoFi first. However, if you don’t mind the slightly beta feel of the experience, Public is pretty decent.

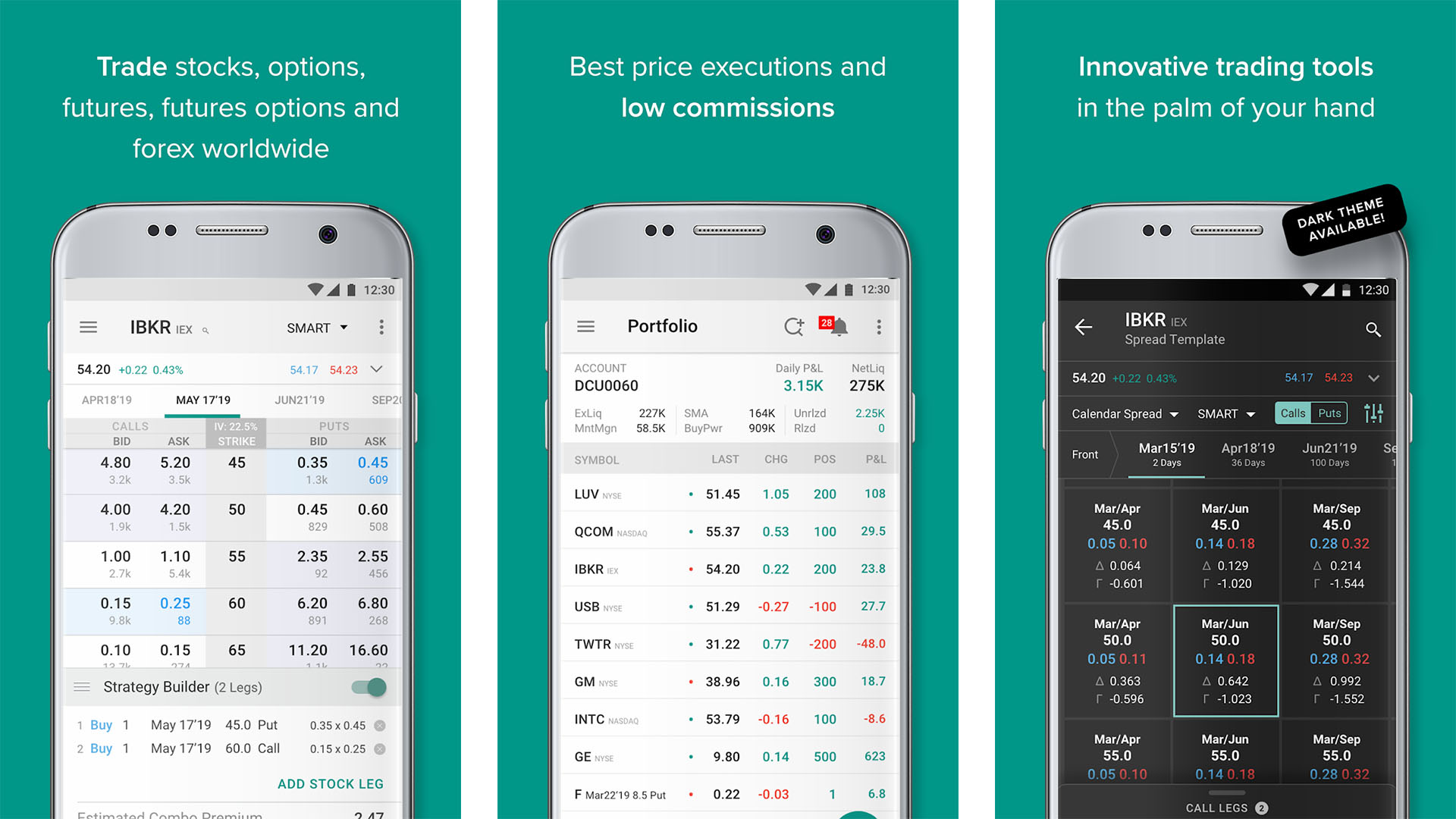

Not free but still good: Interactive Brokers

Price: Free / Varies

Interactive Brokers is one of the most powerful options on the list. You get a bunch of features, more than most other brokers. However, those features come at a price. Smaller or inactive accounts generate fees where most brokers don’t have a minimum trade or balance requirement. It also costs $0.005 (half a cent) per share fee when trading stocks. That’s not great for beginners or for people without a ton of money. Thus, we only recommend Interactive Brokers to folks with larger account balances who don’t mind paying a little extra for some extra features. The app, IBKR, has some problems that need fixed, but the service as a whole is quite good as long as you don’t mind paying for it.

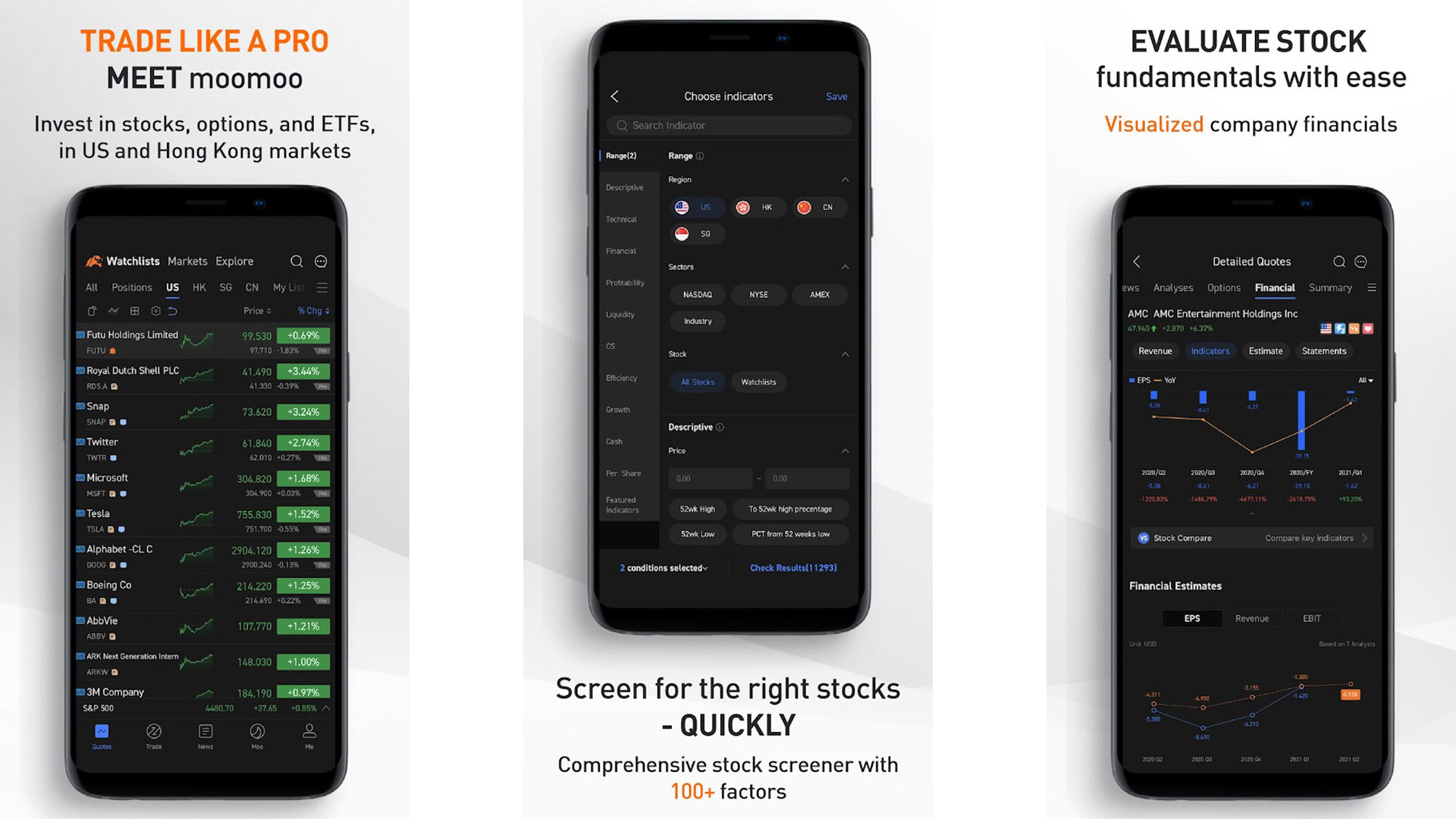

Wildcard option: Moomoo

Price: Free / Varies

Moomoo doesn’t get a lot of love in the brokerage blogging space, but it’s actually not half bad. It’s backed by some larger venture capital firms along with Tencent (yes, that one). It features no commission trades, $0 options contract fees, access to after-hours and pre-market trading, and more. It even gives you Level 2 marketing data for free, something Robinhood charges for via its Robinhood Gold subscription. The app doesn’t have cryptocurrency and the customer service is a bit lacking, but there are social features built-in so you can chat with other traders. We especially appreciate the better than average UI. We also worry because there is no website or desktop app to fall back on if the app has a problem.

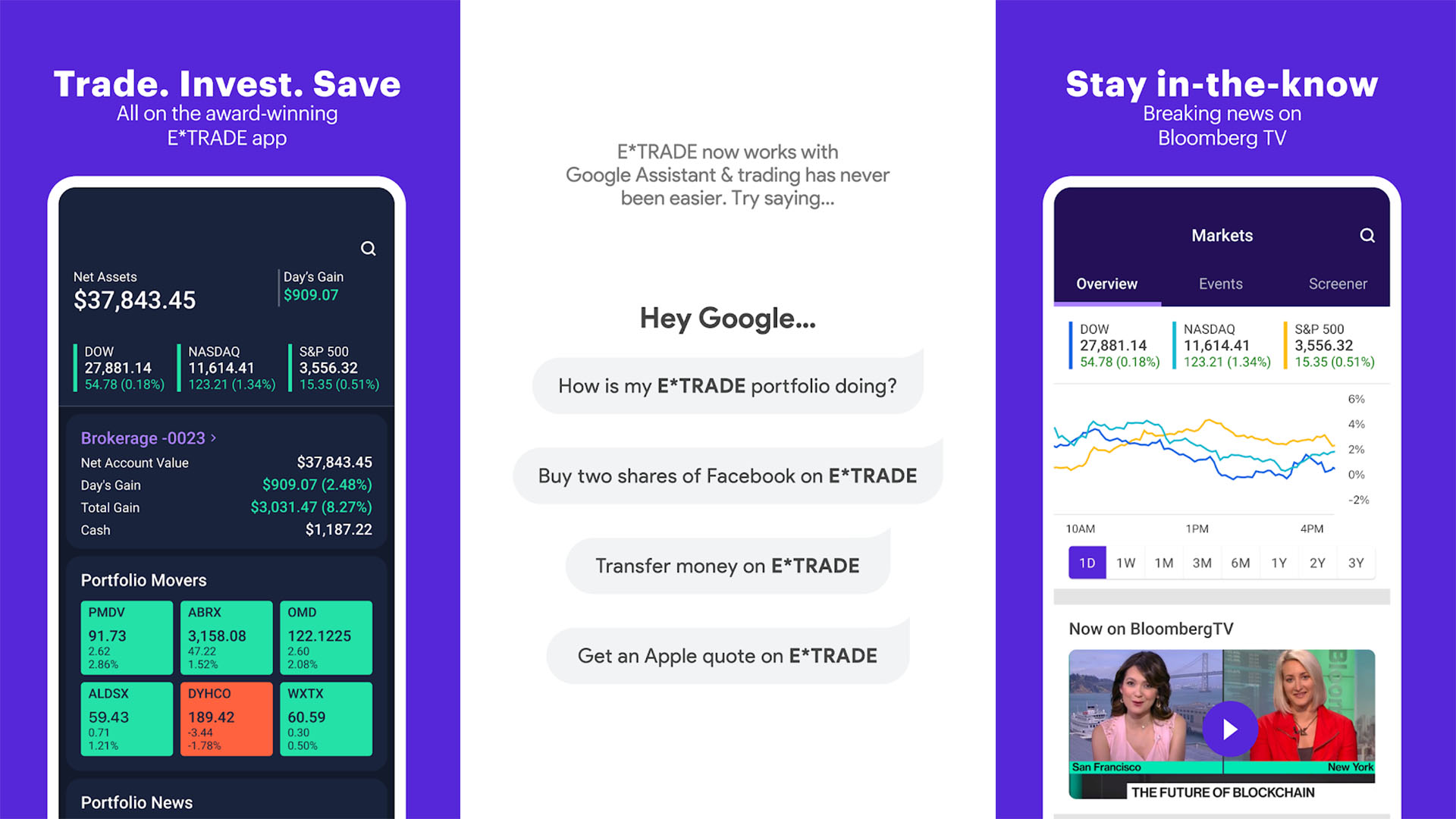

If all else fails: E*Trade

Price: Free / Optional subscriptions

E*Trade is the final of the big four brokerages on this list and one of the worthy Robinhood alternatives. It recently had a mobile refresh for a more modern look that actually works quite well. There are bugs the developers need to work out, but it definitely feels like it was from this decade at least. E*Trade does the basics, including real-time quotes, after-hours and pre-market support, and reasonably decent platform management. The website is definitely good enough for many and that’s good news because there is no desktop app as of the time of this writing. It’s lacking in some respects compared to its competitors, but it’s definitely more than good enough to replace Robinhood.

5 more Robinhood alternatives to try

There are tons of other brokerages that specialize in different things. They aren’t direct competitors to Robinhood but folks who trade a specific way may enjoy a different experience. Here are five more Robinhood alternatives you can try if you want something different.

- Cash app – A ton of people use Cash App to give money to their friends for a beer or to pay for dinner. As it turns out, Cash App also lets you buy and sell stocks along with Bitcoin. You can even transfer your Bitcoin to a Bitcoin wallet after you buy it. Cash App is a bit of a weird experience since it’s mostly focused on transferring money between people, but you can totally buy stocks here if you already use it and kill two birds with one stone.

- Firstrade – Firstrade is right up there with services like SoFi, Webull, and E*Trade. It’s easy enough to recommend for things like stock trading even if it doesn’t support cryptocurrency. However, it recently re-did its app from the ground up and there are simply too many bugs at this time to recommend it above the ten listed above. Keep an eye on it, though, because most apps don’t stay broken forever.

- M1 Finance – M1 Finance is actually an excellent trading app. We don’t recommend it as a main Robinhood alternative because it gears itself for long-term investing. You won’t have instant cash settlements or a ton of active trading features here. The company wants you to buy companies you believe in and hold the stock for a long, long time. If that sounds like you, put M1 Finance on your short list along with Fidelity and Ameritrade.

- Vanguard – Vanguard is right up there with Fidelity for things like long term investments and retirement plans. Vanguard definitely lets you trade stocks and even has tools like its robo-advisor that uses algorithms to help you build a portfolio. The app and website are fairly basic. Active tradres may be happier with something like Fidelity, Ameritrade, or Webull. That said, a ton of people trust Vanguard and like it quite a bit.

- Your bank’s investment platform – Some banks have investment platforms built into their services. A couple of notable examples include Chase Bank and Bank of Ameria (via Merrill Edge). These platforms benefit people who use the existing bank services, but don’t represent great options for people who don’t. We recommend at least checking your bank out to see if it has an investment platform. Generally speaking, transfers happen way faster but they don’t usually have a ton of features for active traders or hardcore traders.

If we missed any great Robinhood alternatives, tell us about them in the comments. You can also check out our latest Android app and game lists by clicking here.

Thank you for reading. Check these out too: