Affiliate links on Android Authority may earn us a commission. Learn more.

Chinese smartphone shipments have plunged, but Xiaomi is surging

Published onApril 27, 2018

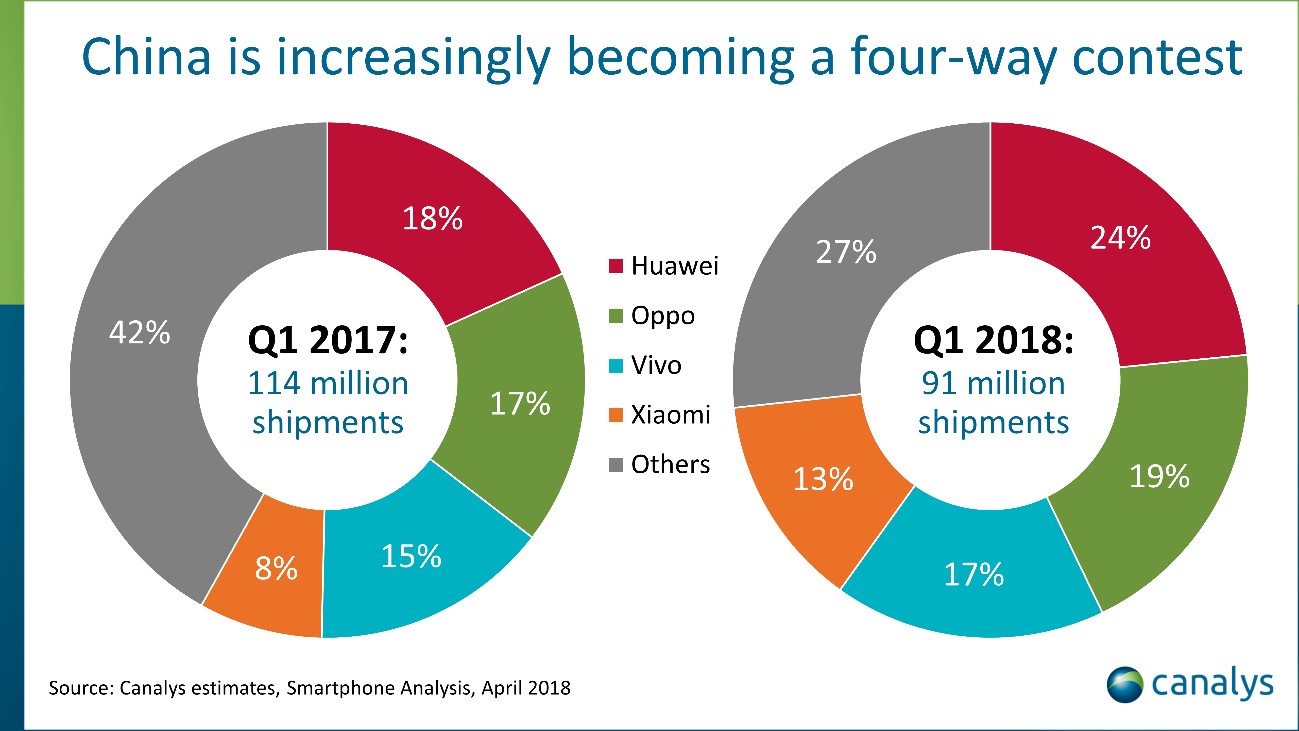

- Smartphone shipments in China dropped 21 percent from Q1 2017 to Q1 2018.

- HUAWEI and Xiaomi were the only major brands to see any growth during this period.

- Xiaomi saw a massive spike of 37 percent year-on-year, with the Redmi range credited for the success.

The Chinese smartphone market saw its first ever annual decline in 2017, as shipments dropped four percent, according to research firm Canalys. It looks like the trend is going to continue in 2018, as shipments sunk by a massive 21 percent in the first quarter compared to Q1, 2017.

Huawei managed to eke out growth of two percent to maintain the top spot, while second and third placed Oppo and Vivo saw shipments drop by 10 percent, Canalys reported.

Xiaomi, however, was a star performer having grown shipments by a massive 37 percent year-on-year. The brand’s strong performance pushed Apple back down to fifth place, after the Cupertino company took the fourth spot in 2017.

Xiaomi was the only brand in the top five to focus on the sub-1000 yuan (~$160) category, Canalyst analyst (say that three times) Hattie He said. It’s thought that “close to 90 percent” of Xiaomi’s shipments were due to the cheap Redmi range.

HUAWEI and Xiaomi were the only two major brands in China to see a rise in shipments.

The top four brands account for an estimated 73 percent of the market. When you include Apple, that means that manufacturers outside the top five are duking it out for 19 percent. The research firm noted that this figure stood at 34 percent a year ago, illustrating the rapid consolidation taking place.

The competition thus makes for a major threat to less prominent homegrown players such as Gionee and Meizu, let alone the likes of Oukitel, LeEco and Ulefone. But massive international players are feeling the heat too. In fact, in addition to Gionee and Meizu, Samsung‘s shipments are also is thought to have shrunk to less than half of what they were in Q1 2017.

The stiff competition has resulted in brands copying marketing strategies and device lineups, analyst Mo Jia said. Only manufacturers of “a certain size” are able to cope with the marketing and distribution costs, though.

Research suggests that Q2 could be better due to new flagship releases, but further copycat designs are expected to introduce a period of “stagnancy.” Manufacturers may have to increase R&D efforts to make headway in the market.

We’ve already seen some OEMs take this route, such as vivo and its X20 Plus UD smartphone, featuring an under-display fingerprint scanner. Then there’s HUAWEI and its triple camera-toting P20 Pro. But are premium features the way to go when the sub-1000 yuan category is what’s proving so fruitful? Wouldn’t more diversity at the lower-end be the better option? Give us your thoughts in the comments.