Affiliate links on Android Authority may earn us a commission. Learn more.

Flashbacks and Forecasts: Samsung in 2016

Published onJanuary 18, 2016

2015 was a tumultuous year for many Android manufacturers and 2016 will be make-or-break for some, as the smartphone market plateaus and competition arrives in increasingly varied forms. With that in mind, we wanted to take a look at the year that was for our favorite Android OEMs, to highlight the highs and lows and to make some predictions for the year ahead.

First off the bat is the world’s largest Android smartphone maker, Samsung.

Samsung in 2015

Despite traditionally being seen as a follower, 2015 was the year that Samsung came closest to being considered an innovator since the introduction of the Note series back in 2011. During 2015, Samsung introduced the first Edge variants to the market and completely redesigned the outward appearance of its flagship S Series.

2015 was the year that Samsung came closest to being considered an innovator since the introduction of the Note series back in 2011.

The Galaxy Note 5 followed this design lead later in the year and hints of it could be found in the mid-range Galaxy A and entry-level Galaxy J series as well. TouchWiz was rebuilt from the ground up and the Exynos 7420 was the chipset to beat. In some ways, 2015 was a year of rebirth for the South Korean manufacturer.

The “new” Samsung

This product “rebirth” was also mirrored in the company’s executive ranks. With Samsung Chairman Lee Kun Hee hospitalized since May 2014, the company, under the leadership of his only son, Lee Jae Yong, began showing signs of a power-shift to a younger generation.

The biggest Samsung staffing news of 2015 was the replacement of long-time Samsung Mobile chief J. K. Shin with Koh Dong Jin, former head of Samsung Pay and Knox and overseer of the Galaxy S6 and Galaxy Note 5.

Samsung is looking more toward enterprise, software and component sales as its primary revenue drivers in future, moving away from a concentration on hardware.

Koh’s background in Knox and Samsung Pay reflect a general sentiment that Samsung is looking more toward enterprise, software and component sales as its primary revenue drivers in the future, moving away from a concentration on hardware. This change in focus can be seen in Samsung’s push forward with its virtual reality headset Gear VR and the appearance of the Gear S2, a very polished and impressive wearable running Tizen OS.

Samsung admitted as much in its Q3, 2015 earnings statement: “In 2016, the growth rate for the smartphone market is expected to slow down continuously….the company seeks to facilitate the global expansion of Samsung Pay, and reinforce the competitiveness of wearable devices to actively respond to market needs.”

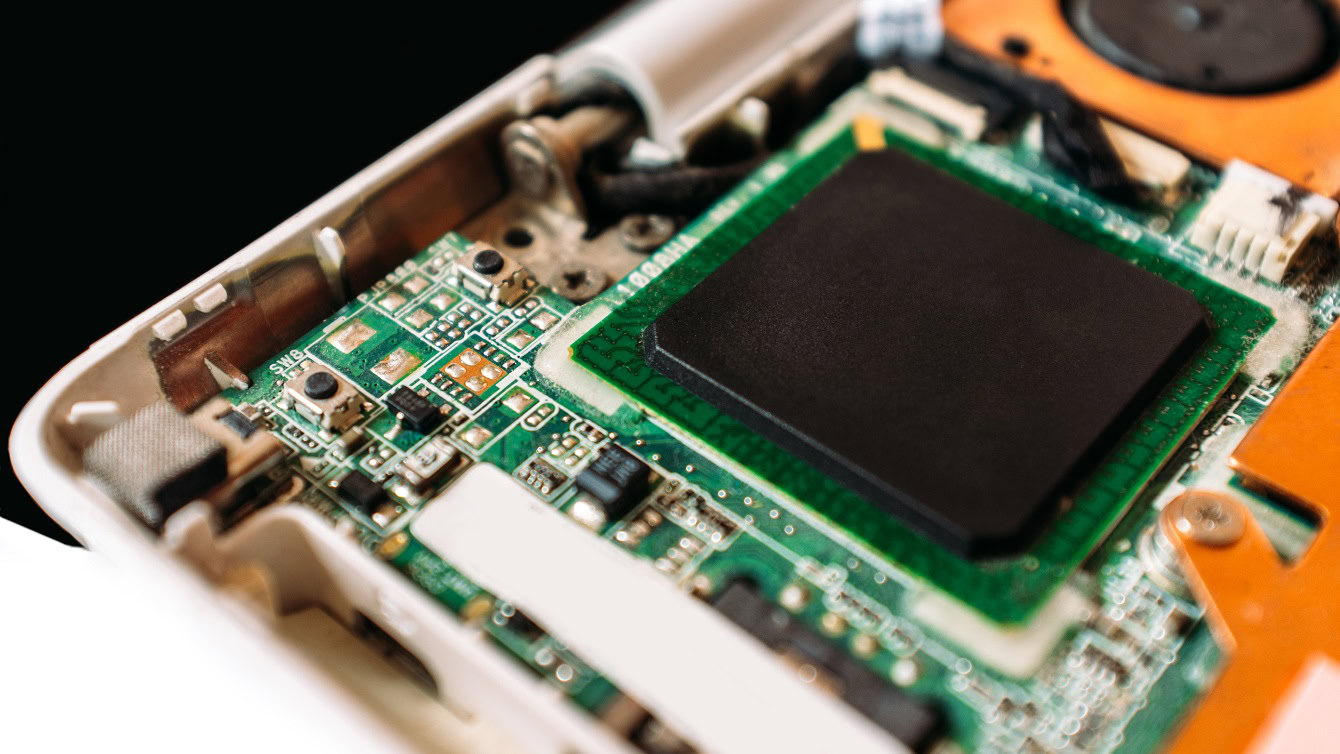

Reliance on component sales

But for the time being, component sales are making up for the vast sums of money being lost by the mobile division. “The profit from semiconductors and display panels offset the weak performances in smartphones and consumer electronics in 2015,” said Greg Noh, analyst at HMC Investment Securities.

Noh was speaking following the release of Samsung’s Q4, 2015 earnings estimates (the audited figures will be out later this month). Despite declining smartphone profits, mostly brought about by lowered flagship prices and increased marketing expenses, Samsung is expected to see a 15% increase in YoY operating profit compared to Q4, 2014. You may recall that Samsung’s Q3, 2015 earnings saw the first operating profit growth in seven quarters. So back-to-back-growth is a good sign.

[related_videos title=”SAMSUNG REVIEWS:” align=”center” type=”custom” videos=”638334,637995,632593,595809″]

A “difficult business environment”

But the situation is not exactly rosy. Cast your mind back to the end of 2014, when Samsung announced it would cut its smartphone product lineup by as much as 30%. Even though the Galaxy S6 models and Note 5 have sold well, remember that the first S6 variants underwent a mid-year “price revision” due to a poor H1, and in H2, Samsung offered a $150 rebate to anyone that bought an S6 variant or Note 5 to help bolster sales.

Samsung is expecting a “difficult business environment” for its mobile division for the foreseeable future.

In Q3, 2015 Samsung said it saw a significant increase in sales of its flagships, but the decrease in price meant declining YoY mobile profits. Fortunately, Samsung shipped more mid-tier devices to generate the cash it made, but even then, Samsung was expecting a “difficult business environment” for its mobile division for the foreseeable future.

It should also be remembered that Samsung’s original fourth quarter predictions for 2015 were $6.8 billion, a figure that was later revised to $6.4 billion and is now being estimated between $6.0-6.2 billion. The thing is, it’s not like Samsung is doing anything particularly wrong; quite the opposite in fact.

Weakening market and aggressive competition

To its credit, Samsung has scaled back and clarified its core mobile product portfolio, expanded comfortably into valuable categories like VR and wearables, refined and sped up its interface, rolled out Samsung Pay and expanded Knox. Furthermore, Samsung is reportedly producing flexible OLED displays for the iPhone 7, and still has its internal memory and semiconductor businesses to rely on for cashflow.

To its credit, Samsung has scaled back and clarified its core mobile product portfolio, expanded comfortably into valuable categories like VR and wearables, refined and sped up its interface, rolled out Samsung Pay and expanded Knox.

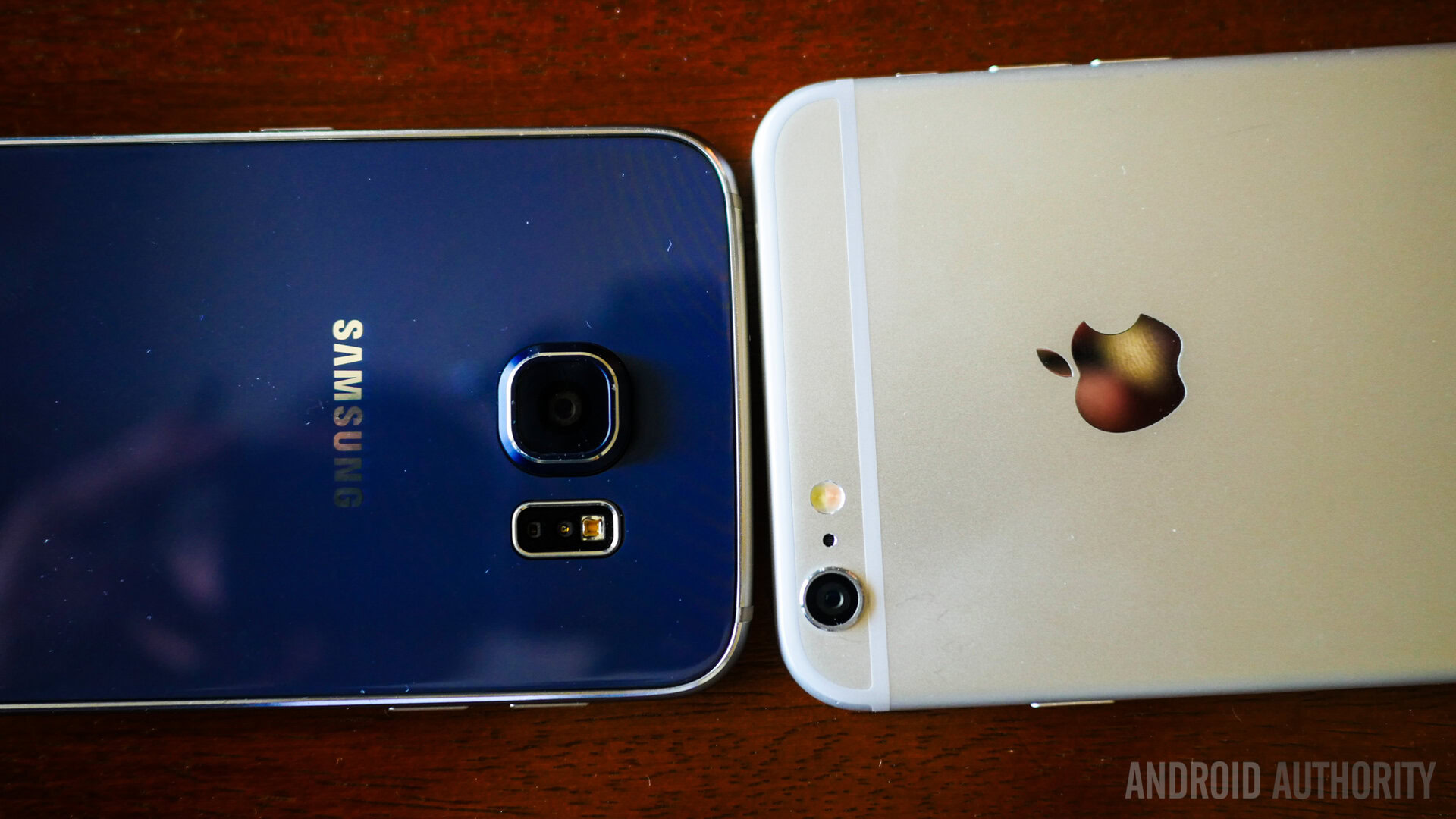

The problem comes more from a weakening smartphone market and increased threats from other OEMs. Companies like Xiaomi are weakening Samsung’s position on the low end of the spectrum and Apple’s larger-screened iPhones have chewed away even further at the high end. Samsung is making some very good moves but they aren’t enough to keep aggressive competitors at bay or counterbalance a plateauing mobile market.

As Samsung CEO, Kwon Oh-hyun, recently said at a company gathering to celebrate the new year, Samsung is expecting slow growth to continue in 2016, sparking a frenzy of “tough times ahead” stories. While these stories focused on Samsung, the company is not alone in facing the slowdown of the mobile telecommunications market: Xiaomi is under-performing, Sony and HTCare circling the drain, LG isn’t going anywhere fast, and Motorola is going through an identity crisis.

So what does the year ahead hold for Samsung? The problem is that there are too many competent competitors in the Android space and Apple has seen a recent resurgence in popularity following the launch of the iPhone 6 and iPhone 6 Plus. With Apple gobbling up all the profits and the “units shipped” mantle being nibbled at constantly from the other end of the spectrum, Samsung has some tough calls to make.

Samsung in 2016

For sure Samsung will look to expand its component sales in 2016, but analysts are predicting “a drop in the momentum for demand in all finished goods in 2016, and that will lead to a decrease in earnings in the parts sector”. So while Samsung may suffer on both the component market and the smartphone market, at least it has a component market; much of Samsung’s competition have no other departments on which to fall back on.

Everything depends on the Galaxy S7

Against this background it is obvious why Samsung is reportedly bringing back microSD expansion to its flagship Galaxy S7, due to be announced at the end of next month. Samsung needs a win, and resurrecting a feature that has been a key factor of success in the past isn’t a bad idea. Not to mention the current UHS-II standard for microSD actually has read-write speeds faster than those in the Galaxy S6’s flash storage.

Samsung will surely do something about its RAM management issues. If recent apps still reload from scratch on the Galaxy S7 then Samsung will deserve the backlash.

The response to the Galaxy S6 design was evidently good enough for Samsung to concentrate on other things. The Exynos 8890 and Snapdragon 820 will bring next-generation performance to the S7 and with 4 GB of RAM in the S7, Samsung will surely do something about its RAM management issues. If recent apps still reload from scratch on the Galaxy S7 then Samsung will deserve the backlash.

Fortunately, the rumor mill also has larger batteries in the new S7 variants, as well as water-resistance. The Galaxy S7 is also likely to appear with a version of Force Touch or 3D Touch, possibly based on Synaptics’ ClearForce technology.

With cameras in 2015 from HUAWEI, LG and Motorola making significant ground on the previously untouchable Samsung, smartphone photography is going to be one of the big battlegrounds of 2016. Samsung is rumored to be doing all kinds of things, from using a sensor with one micron pixels to including a version of Apple’s Live Photos and a 20 MP camera.

Wearables, Tizen and Samsung Pay

Wearables will be bigger this year than ever before and Samsung needs to make its mark in that space. The Gear S2 and the mobile Tizen platform on which it runs are great, but the lack of apps is the Gear S2’s Achilles’ Heel. Addressing this and delivering an equally compelling Android Wear offering are critical if Samsung is going to dominate the wearable space this year.

Expect to see more announcements from Samsung this year regarding enterprise, VR and Samsung Pay, as the company looks to increase its business dealings on the software front. The hardware line up might undergo even more refinement, although rumors of three or four Galaxy S7 variants doesn’t make it look that way. The days of throwing countless devices at the wall to see which ones stick is over for Samsung. These days every move counts, and every product release needs to be solid.

[related_videos title=”MORE FROM SAMSUNG:” align=”center” type=”custom” videos=”667300,664381,650695,647458″]

The forecast

2016 will see Samsung gradually shift from being seen primarily as a hardware company to a software and component company. Internal changes at the executive level will likely continue, hopefully injecting some much needed fresh ideas into the upper echelons and introducing some fresh approaches to regaining lost ground. Samsung’s position as a “maker of everything” certainly insulates its future much better than many smaller companies that are facing the same grim mobile reality.

Samsung’s position as a “maker of everything” certainly insulates its future much better than many smaller companies that are facing the same grim mobile reality.

Is Samsung’s mobile heyday over? Yes. But from the ashes a different company might yet rise to a version of its former glory. The bubble certainly hasn’t burst yet, but Samsung Mobile, like other, much smaller and less well-financed companies, needs to look beyond the scope of traditional smartphones and tablets for the next big thing. It might be virtual reality, it might be wearables, but whatever it is, it needs to be identified and seized upon quickly to counteract a worrying realization: that the market is already saturated.

Also check out – Open letter to the manufacturers: what we want in 2016