Affiliate links on Android Authority may earn us a commission. Learn more.

How can Chinese companies offer great specs at such low prices?

Today’s Android smartphone market is a competitive beast, due in no small part to the increasing prevalence of Chinese flagships boasting cut throat price tags. The likes of OnePlus, Meizu, and HUAWEI’s HONOR brand have not just captured shares of the low cost local market, but are becoming increasingly popular brands throughout Europe and are even breaking into the US.

While certainly smartphone brands are still able to charge a premium for their flagships, there seem to be an increasing number of manufacturers who aren’t offering an awful lot more than these lower cost Chinese OEMs yet still attempt to charge top tier prices. Perhaps this is just to create an image of a premium brand, but Chinese companies also have a few advantages that help keep the costs low compared to their South Korean, Taiwanese and American rivals.

What’s made where?

Delving into the inners of our smartphone’s, many of the most expensive core components actually have very little to do with China, so it’s somewhat surprising to see the company offer such a notable cost advantage. Processor giant Qualcomm is based in the US, MediaTek in Taiwan, and Samsung’s Exynos in South Korea. Meanwhile, large semiconductor foundries from TSMC are based in Taiwan, while Hynix is in South Korea. Memory production is also based in these countries, and Sony’s IMX camera modules are produced in Japan. Even China’s HiSilicon orders its chips from TSMC.

The areas where China does cater locally to smartphone components is in display, battery, and assembly manufacturing. Display technology is probably the one component where there is some discrepancy between manufacturers, due to their choice of AMOLED or LCD technology and cheaper handsets sometimes picking a 1080p resolution over 1440p, although that’s hardly the biggest deal breaker.

In 2016, the price of 5-inch 1080p AMOLED and LCD displays met for the first time, at approximately $14.30 and $14.60 respectively. Chinese manufacturers typically opt for LCD, but so do many expensive flagship phones, including Sony’s Xperia range, the HTC10, LG G5, V20, and Apple’s iPhone 7. While there’s going to be some price differences here, we’re only looking at $5 or so between the cost of cheap LCDs and the most expensive AMOLED panels.

| Samsung Galaxy S7 | Pixel XL | HTC U Ultra | HONOR 8 | OnePlus 3T | ZTE Axon 7 | |

|---|---|---|---|---|---|---|

Display | Samsung Galaxy S7 5.1-inch QHD AMOLED (2560x1440) | Pixel XL 5.5-inch QHD AMOLED (2560x1440) | HTC U Ultra 5.7-inch QHD LCD (2560x1440) | HONOR 8 5.2-inch FullHD LCD (1920x1080) | OnePlus 3T 5.5-inch FullHD AMOLED (1920x1080) | ZTE Axon 7 5.5-inch QHD AMOLED (2560x1440) |

SoC | Samsung Galaxy S7 Snapdragon 820 | Pixel XL Snapdragon 821 | HTC U Ultra Snapdragon 820 | HONOR 8 Kirin 950 | OnePlus 3T Snapdragon 821 | ZTE Axon 7 Snapdragon 820 |

RAM | Samsung Galaxy S7 4GB | Pixel XL 4GB | HTC U Ultra 4GB | HONOR 8 4GB | OnePlus 3T 6GB | ZTE Axon 7 4GB |

Cameras | Samsung Galaxy S7 12MP f/1.7 rear with OIS & PDAF 5MP f/1.7 front | Pixel XL 12.3MP f/2.0 rear with OIS 8MP front | HTC U Ultra 12 MP f/1.8 rear with PDAF, laser AF & OIS 16MP front | HONOR 8 Dual 12MP f/2.2 rear with laser AF 8MP front | OnePlus 3T 16MP f/2.0 with PDAF & OIS 16MP front | ZTE Axon 7 20MP f/1.8 rear with PDAF & OIS 8MP front |

Extras | Samsung Galaxy S7 Fingerprint, Wireless Charging, Samsung Pay, IP68 | Pixel XL Fingerprint, USB Type-C, Daydream | HTC U Ultra Fingerprint, HiFi, USB Type-C | HONOR 8 Fingerprint, USB Type-C | OnePlus 3T Fingerprint, USB Type-C | ZTE Axon 7 Fingerprint, HiFi, USB Type-C |

Price | Samsung Galaxy S7 $670 | Pixel XL $769 | HTC U Ultra $750 | HONOR 8 $499 | OnePlus 3T $439 | ZTE Axon 7 $400 |

When it comes to core internal specifications, many Chinese phone brands feature similar hardware as devices designed outside of the country. Some flagships boast one or two extras, but the differences in bill of material costs isn’t going to make up the considerable gap we can see in the prices. Perhaps differences in manufacturing costs can make up this large discrepancy? Here’s a list of where some of the most well known Android brands put together their phones:

- Samsung – Vietnam, South Korea, China, India, Brazil, Indonesia

- Apple – China, possibly India soon

- Sony – China, Thailand

- HTC – Taiwan

- LG – China, Vietnam, India

- OPPO / OnePlus / vivo – China

- HUAWEI – China, India

- Xiaomi – China, India

With the exception of HTC, all of the other Android manufacturers are building their phones in China, after importing other components from abroad, so again, the differences in production costs appear to be negligible. Furthermore, manufacturing costs only make up between $5 and $10 of a phone’s bill of materials. Really, when it comes to manufacturing, even the costs between a budget Moto E and iPhone 7 is less than $150, so there must be something else that’s resulting in this $350 price gap between a ZTE Axon 7 and the Google Pixel XL.

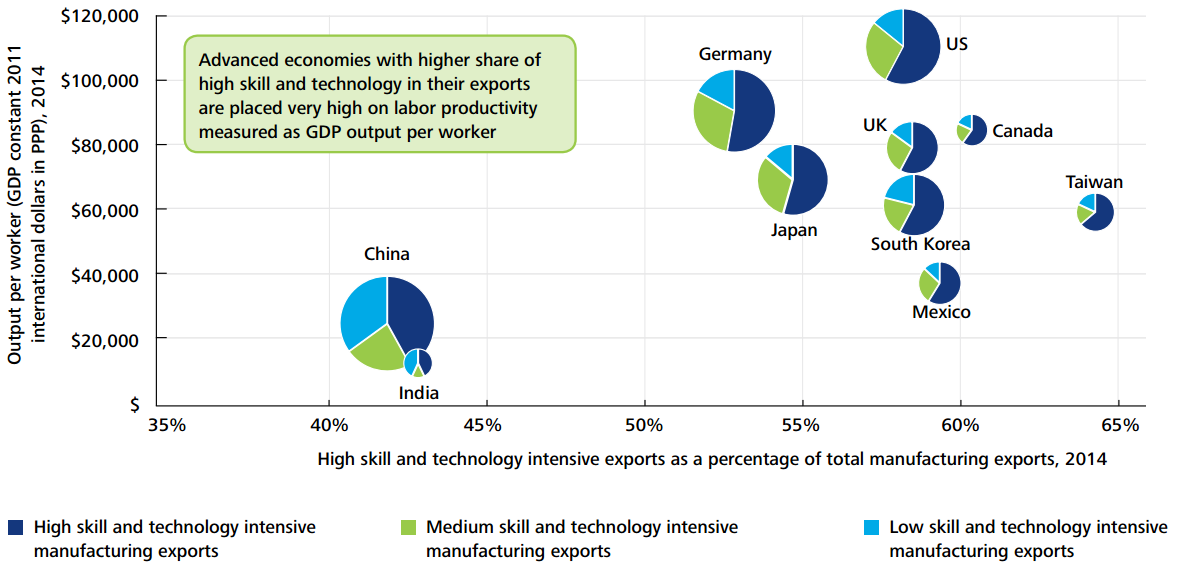

Before we leave the topic of manufacturing costs behind, some interesting research conducted by Deloitte on global manufacturing competitiveness shows how and why China continues to be the hub for manufacturing operations. According to the data, China and the US take positions one and two in the competitiveness rankings, followed by Japan, South Korea, and Taiwan in fourth, fifth, and seventh places respectively.

A deeper look at the type of manufacturing exports leaving these countries confirms our earlier look at smartphone components. The US, Japan, South Korea, and Taiwan see high skill and technology-intensive manufacturing make up the bulk of their exports, which includes electronics components. China shows a different mix, with a much larger amount of low skill and less technology intensive manufacturing exports, suggesting a greater focus on the lower cost manufacturing of finished products, rather than sophisticated ICs.

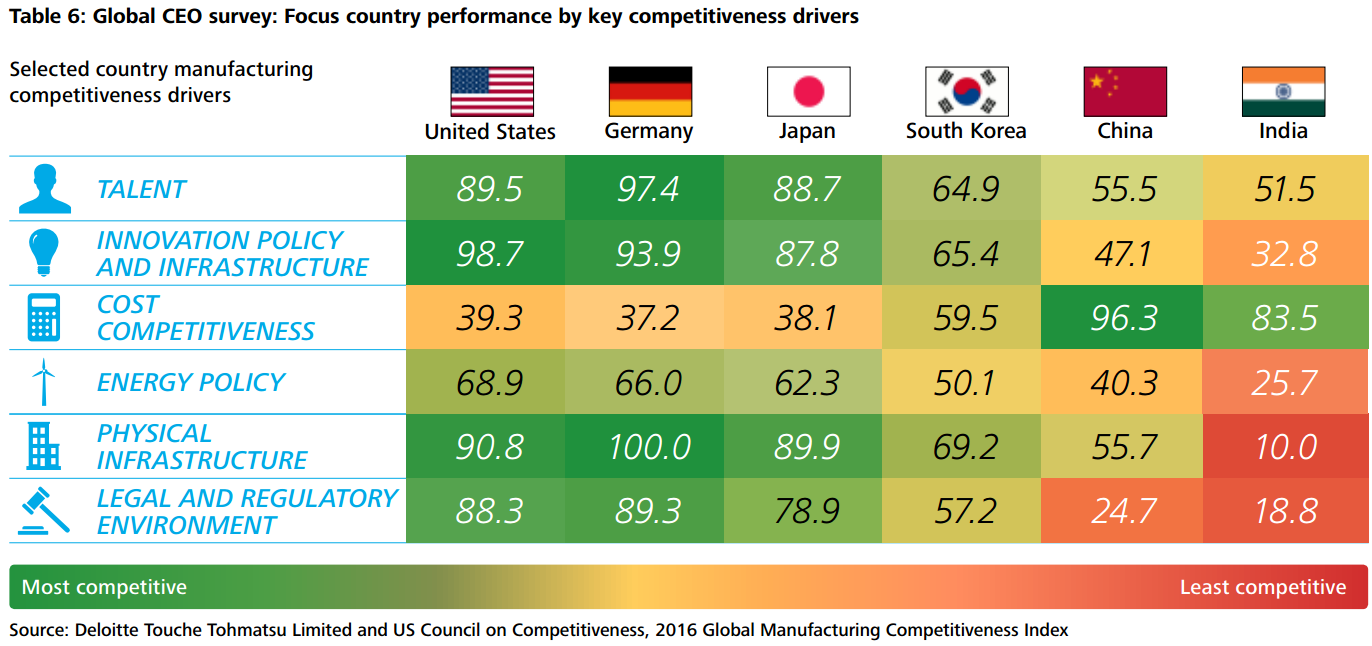

There are a variety of reasons as to why these economies are structured so differently, ranging from education and talent, through to wages, natural resources, and the legal and regulatory structures in which companies have to function. China’s big advantage is its cost competitiveness when it comes to production. This is backed up by data from the same report. When company CEOs were asked to rank the top six countries on a number of individual factors, China came out on top as a clear winner when it comes to manufacturing costs.

Broadly speaking, Chinese factories operate at lower profit margins than those in the US. While this prevents them from filling smaller orders, big bulk orders can be produced in China at lower costs than in other countries, which helps to keep prices down. Combined with all of the factors we’ve just discussed, it makes it rather uneconomical to set up manufacturing operations in more expensive countries.

This all builds into a self-fulfilling situation where Chinese factories can scale up their production sizes, which ensures that bulk orders can be fulfilled whenever needed and in a timely manner, all of which also helps to push their costs down and encourage more bulk orders.

The wage question

When talk turns to manufacturing in China the topic of low wages is often not far behind. It’s still the case that factory labor costs are much lower in China than much of the world, which is why it’s simply not cost effective to set up competing factories in other countries. Although several papers are indicating that actual manufacturing costs in China are rising closer to the US once you factor in productivity and wages are actually cheaper in countries like Mexico.

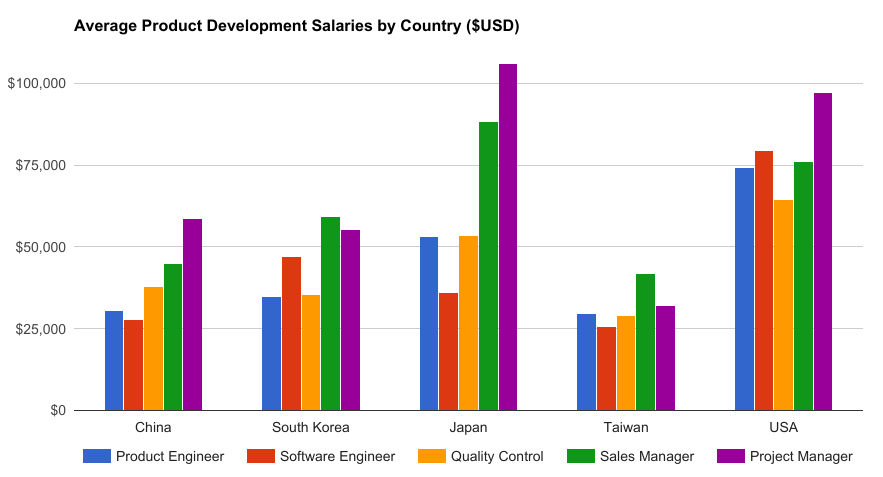

Regardless, most smartphone manufacturers are benefiting from these low wages on the production line equally. However, companies which are exclusively based in China typically also pay their engineers, marketing, management, and customer support staff less than in other countries. The average annual salary of a product engineer in China is $30,500 compared with around $74,136 in the the United States and $53,000 in Japan. South Korea is closer at around $34,800, while Taiwan is actually a tad lower at $29,700. Here’s a breakdown of the salaries for some product development jobs in the biggest smartphone producing countries.

Typically, China offers a notably lower wage for the bulk engineering jobs associated with product development than South Korea, Japan, and the US. Although it’s actually Taiwan that offers the lowest overall salaries for the jobs on this list, but its main engineering jobs roughly command the same salary as in China. Across hundreds or thousands of employees, these salary differences will certainly add up, meaning that product development is certainly cheaper in China and Taiwan than in other major smartphone exporting countries.

While this certainly accounts for some of the cost savings available to manufacturers who operate in China exclusively, it doesn’t really explain why HTC, a Taiwanese manufacturer, charges more for its flagships and why low-cost Taiwanese OEMs haven’t emerged.

New business models

One of the less often discussed, but probably most important aspect of China’s price edge is actually down to the new business models adopted by Chinese smartphone OEMs. Not only do these companies often spend less on advertising, particularly outside of China, but they have also ditched the tried and tested carrier partnerships other countries like the U.S. rely on, turning to online distribution instead.

A big part of your smartphone’s final price tag is actually a cut taken by the distribution and retail channel, followed by a portion divided up by any carrier partners. Keeping tighter control on retail channels, by selling through their own websites or working on smaller exclusive deals with particular retailers, means that manufacturers can keep these costs to a minimum.

There is a downside to a lack of carrier and retail support though. Brands operating this way have a lower store presence and therefore are less able to permeate into the core consumer market as efficiently as other established brands. It also makes expanding into new markets tougher, as brand awareness is harder to generate and distribution channels need to be set up without the assistance of established channels.

This is a particularly large barrier in the U.S., as the vast majority of phones are still being bought on contract plans via carriers. While the prevalence of online flash sales has worked out well for some in China, India, and other Asian territories, it’s not something that would be as successful in the U.S..

This is partly why some of the larger Chinese brands are beginning to build up store presences in their newest markets, although the costs of their devices are creeping up as a result. In Europe, for example, you’ll often find HUAWEI and HONOR devices on the shelves, and Xiaomi and OnePlus are both expanding their presence in physical stores.

Wrap Up

While some have historically associated cheaper Chinese products with inferior manufacturing, 2016’s smartphone market has shown that OEMs from this region are certainly capable of producing handsets that not only feature top of the line specifications, but that also rival familiar flagship brands for build quality as well, all while keeping prices low.

Chinese OEMs are able to eke out a number of small manufacturing and labor cost advantages to keep their retail prices low. However, it is innovative business and marketing tactics that are enabling many of these manufacturers to undercut many of the more established brands, through the use of internet marketing, flash sales, and ditching carrier promotions. We’ve also seen a number of manufactures take a hit on profit margins in the short term to help build market share, like Xiaomi in its early years.

This race to lower prices has certainly put the pressure on a number of legacy smartphone developers, but for us consumers it has produced some very compelling and cost effective handsets.