Affiliate links on Android Authority may earn us a commission. Learn more.

How to use Mi Pay to make UPI payments in India

Published onApril 13, 2019

UPI, or the Unified Payment Interface gateway, has played a big role in the burgeoning fintech revolution in India. This has seen the arrival of several players with Google Pay, PayTM, PhonePe being some of the biggest ones around. With the launch of Mi Pay, Xiaomi too is looking for a piece of the pie. After a prolonged beta test, Xiaomi is now finally rolling out Mi Pay in India. Here’s a quick guide to get you started with Xiaomi’s payment service.

Why Xiaomi phones have ads, or the tricky business of balancing ads and usability

Getting started with Mi Pay

Getting hold of the Mi Pay app is as simple as going over to the Mi App Store on your Xiaomi phone. Our Redmi Note 7 did not have the app preinstalled, despite running the latest version of the operating system, but installing it from the app-store was a cinch. Over time, the app is expected to be baked into MIUI.

How to set up Mi Pay

Once you’ve got the app installed, getting Mi Pay up and running takes just a few seconds. You’ll be prompted to log in to your Mi account the first time you run the app. Since the app runs only on a Xiaomi phone, chances are that you already have a Mi account but in case you don’t, the app will help you register a new account.

The main interface of the Mi Pay is very straightforward and clean. A banner helpfully points out that you will need to link your bank account to Mi Pay to start using the service for UPI payments.

Tap the icon and you will be required to enter in your phone number to further link your bank account. On the next step, the app lists out all supported banks from where you can select the appropriate account. Select your bank from the list and the app shows you your account details. From here on, you can either enter your existing UPI pin or create a new one in case you don’t have one. The app also makes it easy to change your UPI pin in case you’ve forgotten it.

Once you have entered the UPI pin, the app gives you an option to create a new UPI ID. You can continue to use your existing UPI ID as well.

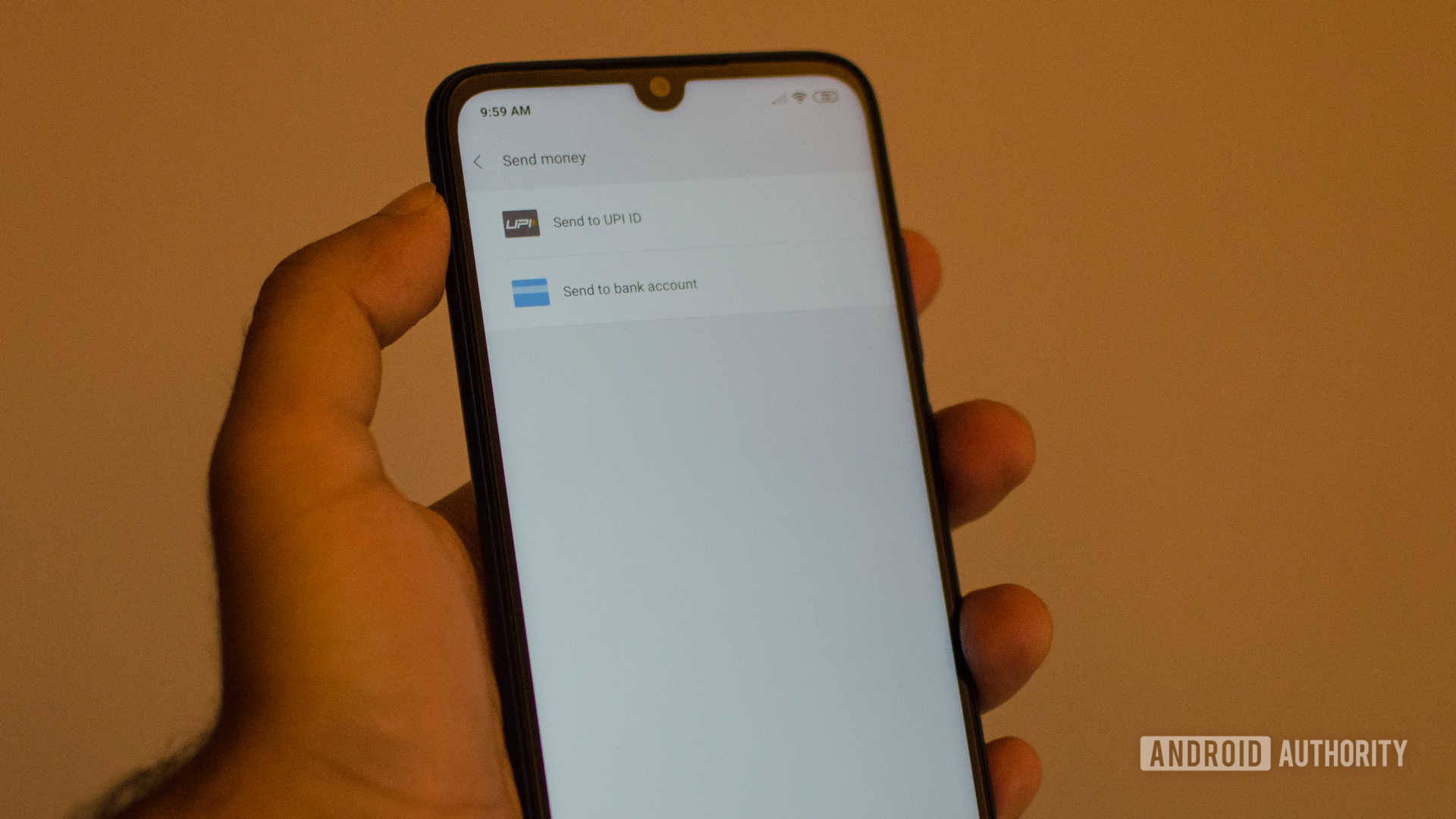

How to send money using Mi Pay?

Like most UPI payment apps, Mi Pay lets you both send and receive money. You can also scan a QR code to make transfers which is quite convenient if you and your friend both use Mi Pay.

The most common use case scenario will, of course, be to simply enter the UPI ID. Once the app has verified the recipient ID to make sure that it is a valid one, you’ll be able to enter the amount and send over the payment.

The app can also pull up details via the contacts app from where you can send over a transfer request or transfer the amount straight away. Your UPI details are tied in with the Mi Account and registered mobile number. For users of Xiaomi phones, this should mean a seamless user experience.

Similarly, creating a transfer request is straightforward. Enter the UPI ID of the user from whom you wish to receive money. You can then set the amount as well as a validity limit for the link. This will send a notification to the user to make the payment to your account.

The Mi Pay app also lets you transfer money using a bank account number and IFSC code should you chose that.

Xiaomi says that Mi Pay is a core app in their India strategy and you can already see some of the deeper integrations made here. For one, both the contacts and SMS apps have an option to transfer money. You will soon be able to make purchases on the company’s store using Mi Pay.

How to pay bills using Mi Pay

An added incentive of using an integrated payment solutions app is that it offers an easy way to pay off bills, recharge mobile phone plans and more. Mi Pay is no different. The app lets you recharge your mobile phone, is capable of recognizing the circle and operator using your phone number. You can then look up plans or enter the recharge amount to continue.

The process for paying bills is similar to that for transferring money to an individual recipient. Select the service for which you wish to make a payment. Following this, Mi Pay gives you a larger list of all the supported operators. In the case of DTH services, this includes all the popular operators like Tata Sky, Videocon, BIG TV, Airtel and more. There are similar options for broadband operators, gas payments, etc.

Why should I use Mi Pay?

The biggest advantage of Mi Pay over a third party app is the deep integration it offers in system apps. From the contacts and messaging integration, Mi Pay makes it easy to send money to your contacts.

Mi Pay, however, lacks the cashback incentives that Google Pay and PhonePe offer to make it a lucrative option for potential users. With the app preloaded on Xiaomi phones, we suspect the company expects most users to opt for the easier option and use Mi Pay. It remains to be seen how aggressively Xiaomi pushes the service in India.

Are you an existing Xiaomi customer? Would you use Mi Pay over Google Pay or PayTM? If so, why? Let us know in the comments section.