Affiliate links on Android Authority may earn us a commission. Learn more.

Features

Forget the Pixel Watch 4, this is the Wear OS watch I’m looking forward to the most

0

Features

After the latest One UI 7 issue, I can’t recommend buying a Samsung phone

0

Guides

With its new plans, is Google Fi finally competitive again?

0

Top stories

Latest poll

What do you think of Android's upcoming UI overhaul?

7124 votes

In case you missed it

More news

Nick Fernandez5 hours ago

0

Amazon Luna: Everything you need to know about Amazon's cloud gaming service

The best new Android apps and games for May 2025

Andy WalkerApril 30, 2025

0

These are my 10 favorite Android games to play with a controller

Nick FernandezApril 30, 2025

0

Google Pixel 9a problems and how to fix them

Andrew GrushApril 22, 2025

0

Here's why I turned off AI Overviews and why you should consider it too

Andrew GrushApril 21, 2025

0

Amazon Luna: Everything you need to know about Amazon's cloud gaming service

Nick Fernandez5 hours ago

0

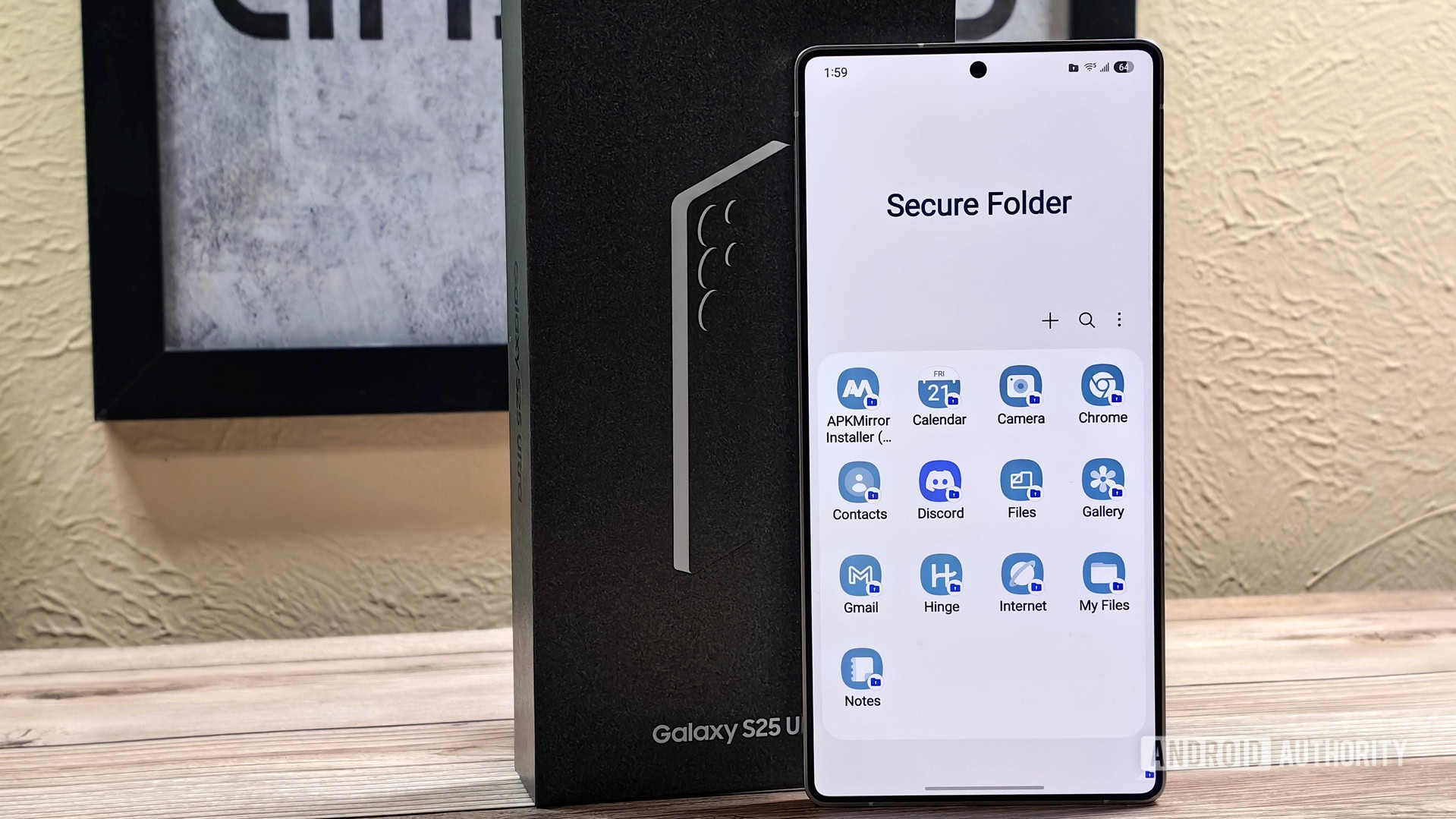

One UI 8 might finally fix Secure Folder's biggest security flaws

Aamir Siddiqui7 hours ago

0

Google reacts to the iPhone 17 Air's rumored Pixel-like design with new video skit

Hadlee Simons8 hours ago

0

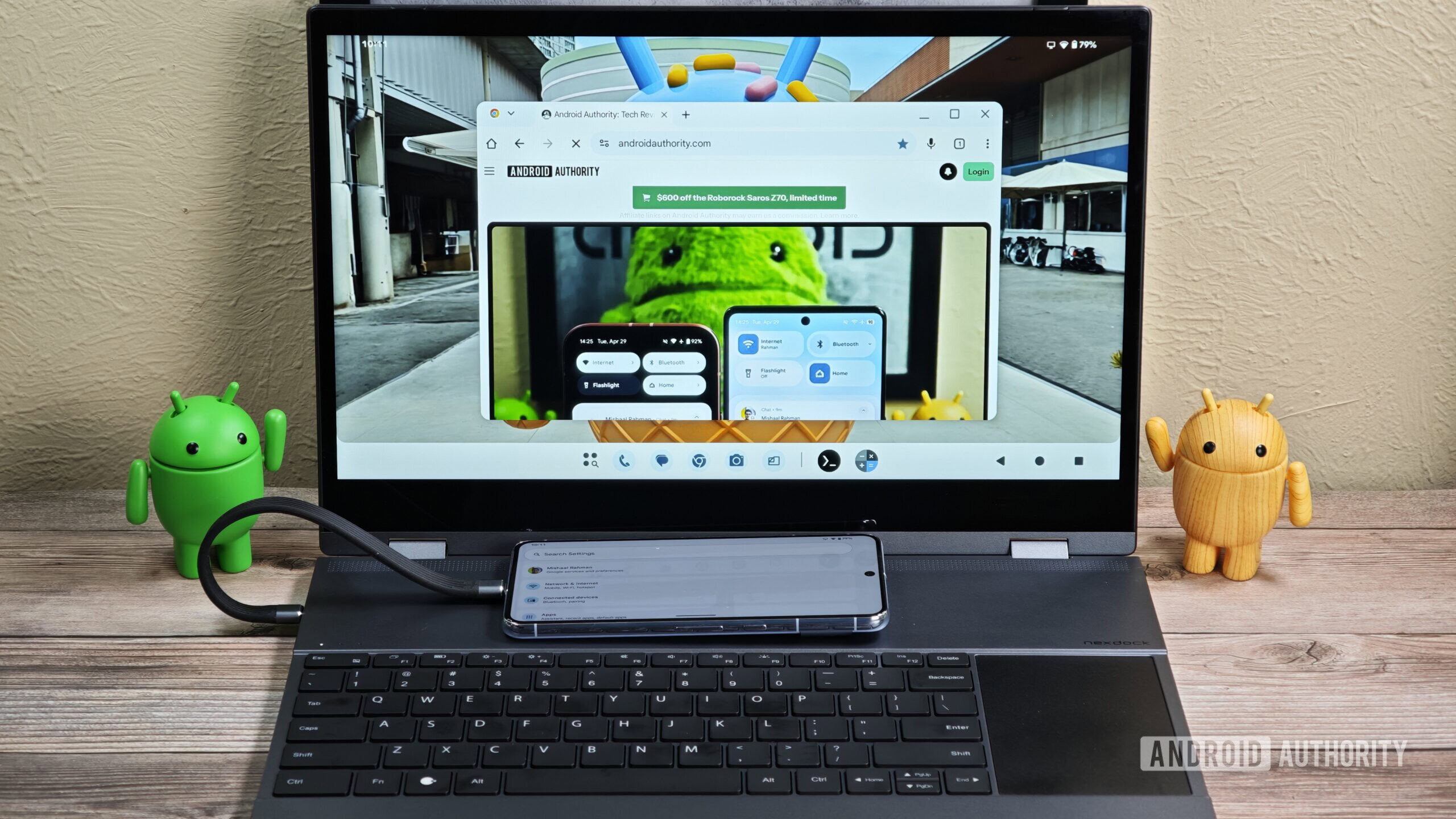

One UI 8 leak suggests Samsung DeX could borrow a lot from Android 16's desktop mode

Aamir Siddiqui9 hours ago

0

Samsung may be planning an unusual move for its next Galaxy Watch update

Adamya Sharma12 hours ago

0

Google takes a page from Apple's playbook with new Material 3 Expressive battery icon

Christine Romero-Chan19 hours ago

0

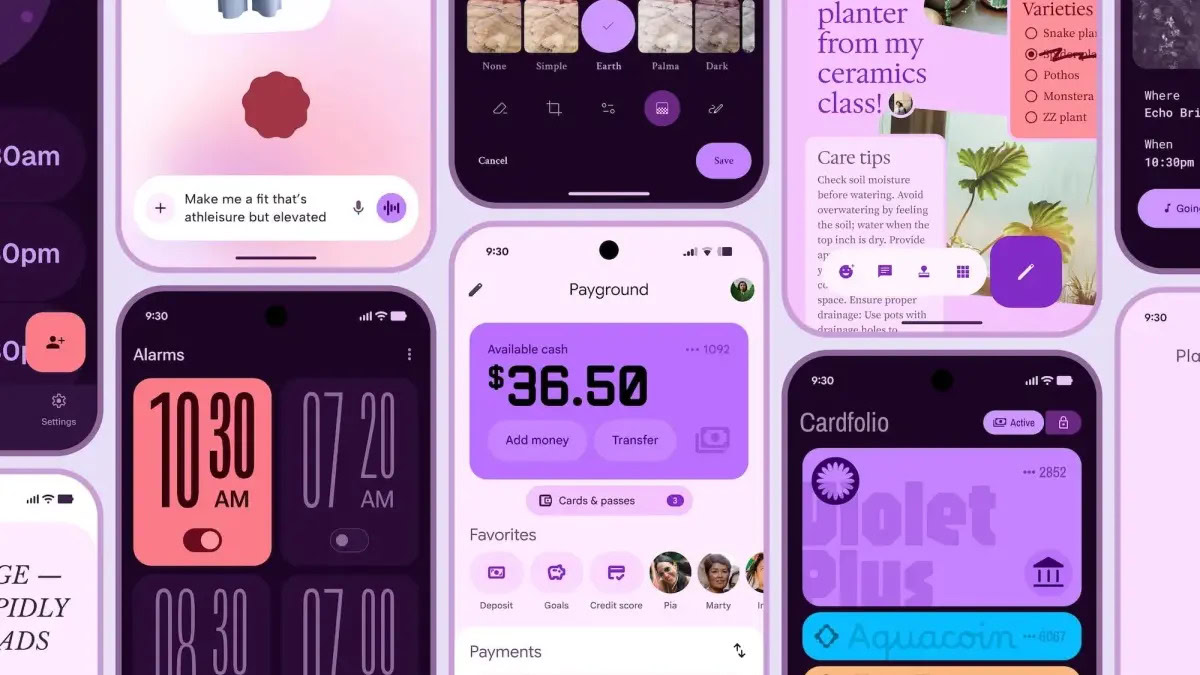

Oops! Google lets Material 3 Expressive details slip out online early

Ryan McNeal20 hours ago

0

There's good and bad news about the batteries in Samsung's next-generation foldables

Christine Romero-Chan21 hours ago

0

Here's your first look at Live for Google AI Mode (APK teardown)

Stephen Schenck23 hours ago

0

Switched to Google Fi Essentials but can't change your Google One plan? You're not alone

Andrew GrushMay 5, 2025

0