Affiliate links on Android Authority may earn us a commission. Learn more.

Qualcomm vs Apple: the race to own Bluetooth audio

March 21, 2018

The 3.5 mm headphone jack isn’t dead yet, but some manufacturers are rather unscrupulously pushing consumers towards Bluetooth and into their broader product ecosystems. Regardless of the persistent quality and connectivity issues, the convenience of wireless headphones is seeing big growth in demand. Apple has seized on this opportunity, doing what it does best by marrying convenient works-out-of-the-box technology and software services like Apple Music with high-end marketing. In addition, the growing market for wireless speakers and smart home products is pushing wireless connectivity to the forefront of any audio product’s feature list.

In the Android space, Sony is perhaps the most suitable comparison to Apple, with its own Xperia handset brand and a popular range of wireless headphones and even its own smart speaker. However, Sony has nowhere near the mobile market share that Apple can capitalize on, and although its LDAC technology might catch the eye of the audiophile crowd, it has nothing like the brand penetration of Apple’s Beats. Google is also competing in this space with its Pixel Buds and Home speakers, but its audio reputation is only just getting off the ground.

When it comes to smart speakers, Apple is undoubtedly late to the party and has a long way to go to catch up with market leader Amazon and second place Google. Still, with HomeKit integration and a huge smartphone install base, if anyone has a chance of catching up, it’s Apple. And when combined with the rest of its ecosystem, the company is clearly making a broad play for audio. Is anyone else able to grab such a big slice of the market?

Enter Qualcomm, best known in mobile for its Snapdragon processors but with an ever growing portfolio of cutting-edge audio focused hardware for headphones and speakers. While its headphone aptX codec is relatively well-known, the company is hard at work to provide manufacturers with features that make Bluetooth headphones and wireless speakers more useful and appealing to consumers. There’s also a growing segment of the smart speaker market being filled up by brands outside of Amazon and Google, many of which need hardware platforms to get their designs off the ground.

Apple and Qualcomm have two very different business approaches to the wireless audio market, but these are emerging as the two companies that are most likely to clash.

Branding vs hardware

As is usually the case with Apple, the appeal of its products doesn’t necessarily rely on having the very best hardware, but on the power of its brand image. From the iconic look of its AirPods to the huge marketing budget and celebrity endorsements of its Beats brand, Apple is highly visible. Qualcomm, on the other hand, has nothing to go on but its underlying hardware, as it doesn’t sell any final products to consumers.

Apple’s solution doesn’t support the high sample rates or 24-bit audio often sought after by the enthusiast end of the market. It’s AAC codec is limited to just a 264 kbps bitrate, which is a lower transfer rate than aptX, aptX HD, and LDAC. However, you won’t have to worry about any reconversion issues when streaming files from AAC-based services like Apple Music. Even so, it’s clear that Apple isn’t targeting the truly high-end specifications that often catch headlines in audio circles.

Apple’s audio strategy doesn't rely on high-end codecs or trends like Hi-Res audio, instead premium branding and instant pairing are the key selling points.

Instead, Apple’s strategy relies on its traditional combination of premium branding, see Beats, along with its “just works” mentality. You only have to look at the super simple way that its AirPods connect to a smartphone for the proof, which is a lot faster and less fiddly than connecting traditional Bluetooth headphones. Apple’s end-to-end control over its hardware pays dividends here, simplifying its implementations and allowing it to exert influence and control over what is otherwise a universal, albeit rather basic, wireless standard. Of course, Apple has to support all Bluetooth products too, but its best features are reserved for its own products.

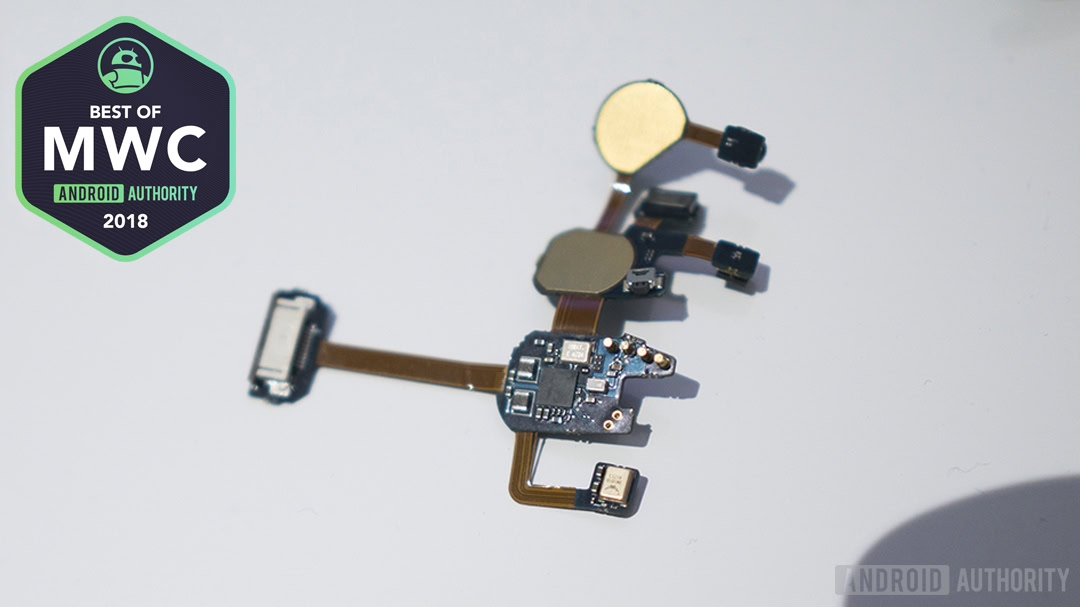

In this sense, Qualcomm is not so different. It’s Broadcast Audio technology runs on a number of of its audio SoCs for speakers, and now on its Snapdragon 845. The company’s latest TrueWireless Stereo Plus also requires Qualcomm hardware for separate left right channels and to benefit from 10 percent power savings. Although regular TrueWireless can work with phones using other processors. This is hardly surprising though, as Qualcomm is having to develop both new hardware and software to augment the default Bluetooth feature set.

Qualcomm doesn't sell headphones but is instead solving hardware issues like true wireless, multi-channel sharing, and battery life.

Qualcomm’s business model could not be more different from Apple’s. While Apple builds technologies for its own products, Qualcomm designs parts and features for other companies to implement, and it’s catering to both source and playback hardware, such as smartphones and speakers. The company is building an audio ecosystem with a unified feature set that can rival, if not surpass Apple’s closed platform.

It’s not perfect, but without Qualcomm undertaking this work behind the scenes, we may have ended up with dozens of different incompatible proprietary solutions, where Sony, Samsung, LG, and others all locked their best features away behind proprietary standards. Such a situation would be a nightmare for consumers to navigate.

Solving problems

Unfortunately for us consumers, Bluetooth was never really designed for high-quality audio and hasn’t been updated in a meaningful way to cater to today’s more advanced, high-end features and needs. High bit-rate audio, instant pairing, strong and stable connections at a distance, true wireless, broadcasting to multiple devices, and sharing connections aren’t supported by default. Instead these require third-party advancements to make possible.

A couple of companies and wireless audio codecs have stepped in to try to tackle the quality issue, as the baseline SBC option really doesn’t cut it. Ideas like Fast Pair baked into Google Play Services are another bandaid for the most common problems, but fragmentation remains the biggest problem with Bluetooth, as only the Google’s Pixel Buds and Libratone’s Q Adapt On-Ear support Fast Pair on Android so far.

Both Apple and Qualcomm are finding ways to plug up these problems with Bluetooth and help expand the ecosystem by producing solutions. Furthermore, the growth in smart home speakers is now demanding internet connectivity, casting support, voice keyword detection, multi-microphone input support, and noise cancellation technologies to bring consumers the functions they’re now after. This additional product complexity increases research and development costs, and so rather than reinventing the wheel, it’s more cost effective for speaker manufacturers to buy the SoC and digital electronic design from experts so that they can focus on the audio circuitry and acoustic design.

While Apple may be in the lead when it comes to headphones, Qualcomm’s Smart Audio platform with Alexa and Assistant certification is likely to be picked up by a number of third party smart speaker manufacturers this year. Not forgetting that it’s latest Bluetooth audio chipset is promising significantly longer battery life, which could also see an uptick in adoption in the headphones space.

Apple is more aggressively trying to corner the market with solely proprietary solutions that it can control end-to-end, while Qualcomm has the more difficult job of providing a wide range of options to various companies. Having Qualcomm alone solve these issues isn’t ideal for consumers though, as this still leads to inconsistent features across products that don’t use Qualcomm’s hardware. Take the Samsung Exynos rather than Snapdragon powered Galaxy S9, for example, or HUAWEI’s smartphones that use the company’s own processor, or speakers that use their own app to sync up Broadcast Audio. It would be preferable for consumers if Bluetooth SIG updated its standard with better audio features and enforced these improvements on those looking to implement its future specifications.

Who will win the Bluetooth battle?

In some ways we’re looking at another Apple vs Android, or Mac vs PC, but this time for the wireless and smart headphones and speaker markets. Apple is once again providing internal solutions that look to bring consumers into its pretty walled garden. Qualcomm is fulfilling its typical role of providing various other manufacturers with the essential tools to build their own rival products and to help keep the market a vibrant and competitive place. In that sense the Qualcomm’s audio division is indispensable.

As with similar battles for PCs and smartphones, neither side is likely to be able to corner the wireless headphone or speaker markets entirely. For Apple, its iPhone and Beats brand awareness is already huge in both the mobile and headphone spaces, and its recent expansion into the smart home speaker market is only going to improve this profile as a leading audio company further. Even if Apple’s ecosystem may not have all of the best features, the “simply works” strategy isn’t going to lose its appeal.

Bluetooth headphone manufacturers looking to close the gap on Apple's lead need chipsets and development ecosystems from the likes of Qualcomm.

However, a powerful and agnostic platform taking input from multiple partners is likely able to convert this feedback into faster innovation and more flexible products that meet emerging needs. So rather than dictating what the market gets, Qualcomm’s business model is better suited to giving partners, and therefore consumers, what they want. Furthermore, Qualcomm will be powering a wider range ofproductss at various price points, ranging from cost effective headphones that undercut Apple, right up to audiophile brands that have a far better reputation than Cupertino in these markets.

Time will tell if either can pull ahead, but a safe bet will be on a heated behind-the-scenes battle between the two as they race to provide killer wireless audio features.