Affiliate links on Android Authority may earn us a commission. Learn more.

Samsung to buyback $2 billion worth of shares to stabilize its share price

Published onNovember 26, 2014

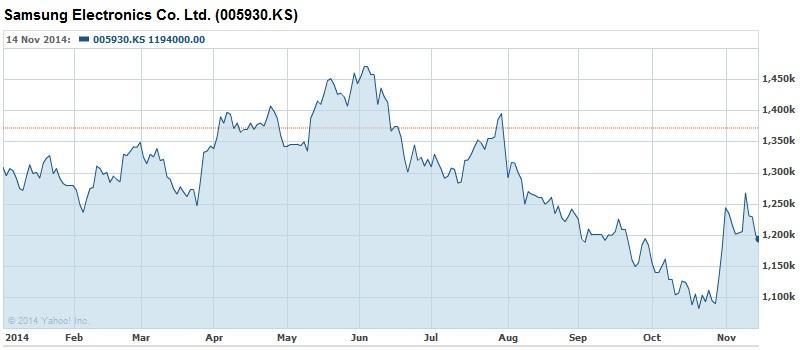

Today, Samsung Electronics has announced that it intends to buyback $2 billion worth of shares, following a year that has seen weakening financial results and declining smartphone sales.

Having faced successive quarters of falling profits and mobile sales, Samsung’s shares have declined 12.5 percent so far this year. Samsung’s share price bounced back slightly at the end of October, but is still far behind the boarder market average of a 1.5 percent decline over the same time period.

Samsung will acquire 1.65 million common shares and 250,000 preferred shares, according to a regulatory filing, making this Samsung’s second-largest buyback scheme. The last time the company repurchased shares was back in 2007.

There could be a number of reasons as to why the smartphone giant intends to buyback so many shares. Reducing the number of shares on the market could increase the dividend payout per share, despite weakening profits, and help to stabilize the share price by removing influence from unnerved investors. Alternatively, the company could be seeking to profit from a potential undervaluation, this would indicated that Samsung expects its share price to recover in the longer term.

The buyback announcement follows a string of expected policy shifts for Samsung in recent weeks. The company appears to be making a significant reshuffle for next year, a change in management and restructuring of its mobile division are expected to come into force come early 2015, as well as a new approach for mobile product development.

2015 is set to be an even more difficult year for Samsung’s mobile business, as investors and consumers wait to see if the company can reinvigorate its mobile division.