Affiliate links on Android Authority may earn us a commission. Learn more.

Report: OEMs selling phones in US under $700 see massive growth, because duh

August 20, 2019

- The OEMs that saw the most smartphone market share growth in the US this past quarter are OnePlus and Google.

- Both companies offer smartphones that start under $700.

- The best-selling smartphone of the year so far is the iPhone XR, itself a “cheaper” device.

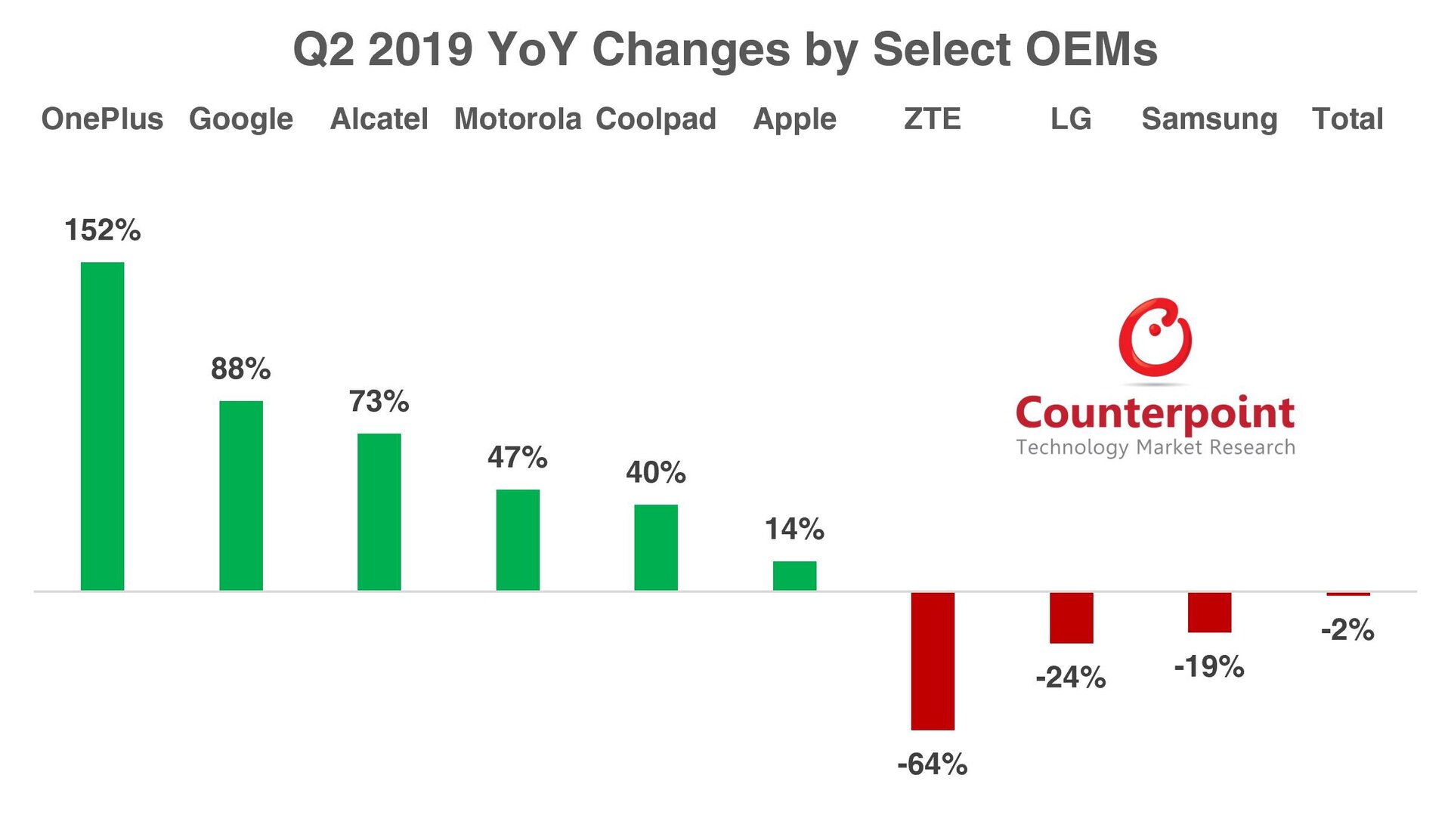

A new report from Counterpoint Research shows how different smartphone OEMs are faring in the United States as well as the smartphone market share of those companies. The overall industry saw a 1.5 percent decline year over year when comparing Q2 2019 to Q2 2018.

However, a few OEMs saw some massive growth during this same time period. Wouldn’t you know it, the two companies that saw the most growth are selling phones that start under $700, namely OnePlus (the OnePlus 7 Pro starts at $669) and Google (the Google Pixel 3a starts at just $399).

OnePlus saw stunning growth in the U.S. to the tune of 152 percent. This is an indication that the OnePlus 7 Pro is likely the best-selling smartphone the brand has ever released, at least here in the United States.

Google also saw some massive growth in the country: 88 percent year-over-year. This success is no doubt directly related to the Pixel 3a and Pixel 3a XL, which offer all the important aspects of the main Pixel line (namely the camera and the stock-like software experience) without the steep price tag.

Elsewhere, Alcatel, Motorola, and even Coolpad saw significant growth, all of which offer cheaper devices.

Apple also saw some small growth — 14 percent year-over-year — which is probably attributable to the iPhone XR. That device is the best-selling smartphone of the year so far. Wouldn’t you know it, the iPhone XR is also the “cheaper” entry in Apple’s latest line of phones, starting at just $749.

Meanwhile, LG and Samsung — two companies usually criticized for high-priced products — saw sales declines year-over-year at 24 percent and 18 percent respectively. ZTE also saw a massive decline in sales, but that’s to be expected.

Counterpoint suggests these shifts in smartphone market share are likely due to people holding on to devices for longer (over two years), taking advantage of bring-your-own-device programs, as well as buying more phones from third-party sources rather than through their carrier.

The overall conclusion of this report is simple: people want cheaper phones that don't skimp on specs and design.

One of the ways OEMs “hide” the price tags of their smartphones is by depending on carrier payment plans to soften the blow. A customer can see a $25-per-month device and then a $35-per-month device and think getting the more expensive one is not too bad a deal. However, they don’t realize that the cheaper phone totals in at $600 with a 24-month plan while the more expensive one totals in at $1,050 with a 30-month plan. If people don’t buy through carriers, though, that strategy doesn’t work anymore.

This report from Counterpoint essentially boils down to one conclusion: OEMs need to offer cheaper phones without skimping on specs and design. If they don’t, the brands that do will eat their lunch.