Affiliate links on Android Authority may earn us a commission. Learn more.

Worldwide smartphone shipments up 12 percent YoY

Published onJuly 24, 2015

It’s that time of the year when analysts parade out market data for the midpoint of the year, so we can assess who the biggest winners and losers have been in the past twelve months. IDC, one of the big names in market data, has just released its comprehensive breakdown of how the smartphone market stands in Q2 2015.

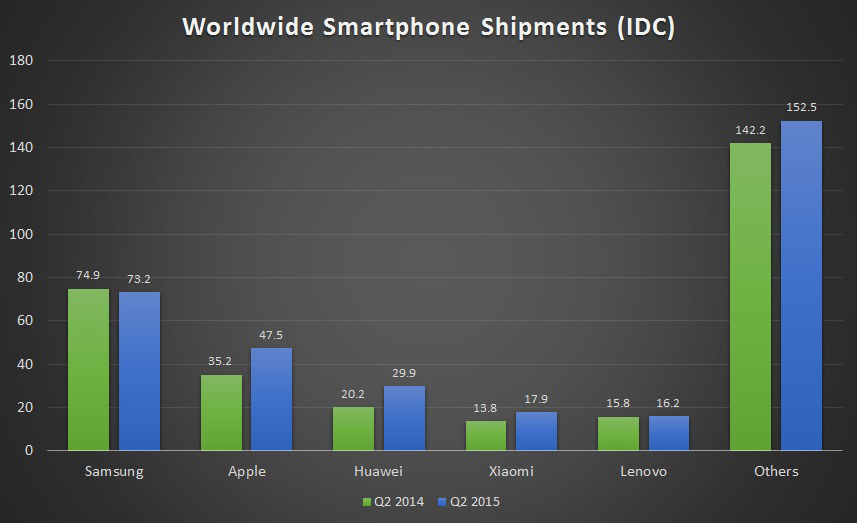

Starting with the big picture, it is good news for the mobile industry as a whole. Worldwide smartphone shipments have leapt by another 11.6 percent compared with the same time last year. Vendors have shipped a total of 337.2 million smartphones in the second quarter of 2015, compared with 302.1 million units in the same period of 2014.

As you may have guessed, it is a combination of both high-end flagships and competitively priced smartphones that are continuing to drive consumer demand.

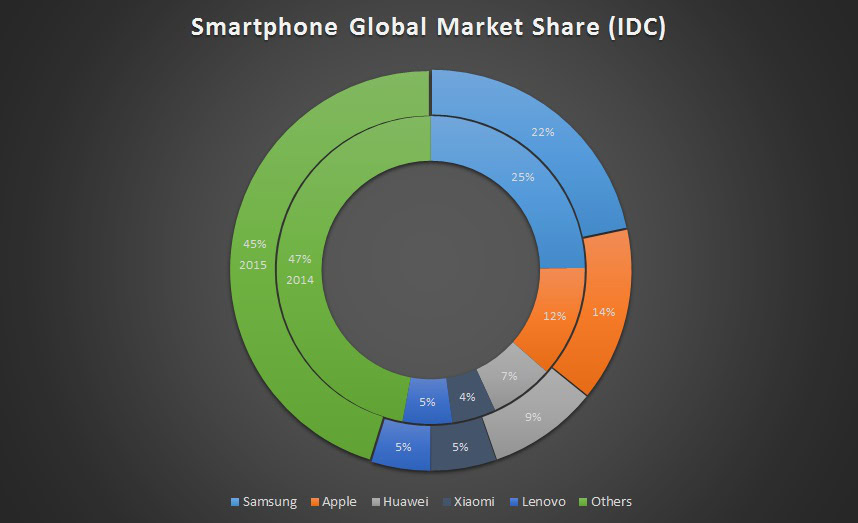

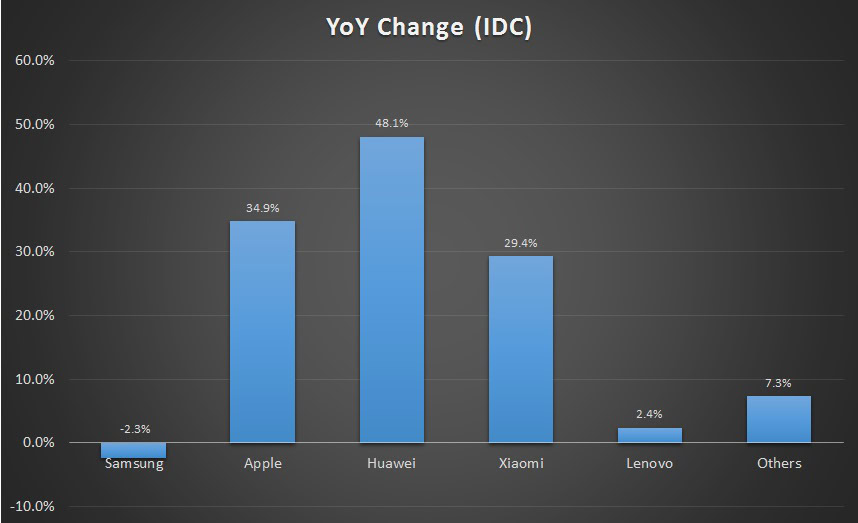

Turning to the industry leader, Samsung, we actually see a stagnation in shipments from Q2 2014 to Q2 2014, despite apparently strong demand for its new Galaxy S6 smartphones. The issue for Samsung appears to be that it incorrectly estimated demand for its S6 Edge smartphone. Reports from Korea suggest that the company has been trying to fulfil consumer demand but also has a stock of regular Galaxy S6 handset that it can’t sell. Samsung will likely be pinning hope on the upcoming Galaxy Note 5 and S6 Edge Plus to drive sales higher later in the year.

Apple, on the other hand, has seen its shipments increase over the past year, after finally launching a smartphone that caters to consumer demand for larger smartphones. Interestingly, IDC suggest that Apple is also seeing big success in China, as higher earners move from local brands to higher-end models.

The rest of the top five global smartphone vendors are now all Chinese manufacturers, according to ICD. TrendForce awards fifth place to LG. Either way, just like TrendForce’s data from earlier in the week, the consensus is that the most notable shipments gains have come from Chinese brands, such as HUAWEI and Xiaomi.

Xiaomi has achieved a huge 29.7 percent year-over-year growth in terms of shipments, through a combination of continued growth China and expansion into new territories in India, Asia and Brazil. HUAWEI has focused its attention on Europe this year, which, combined with strong domestic demand, has seen considerable growth as a result, up a huge 48.1 percent.

[related_videos title=”Low-cost phones from Asia:” align=”center” type=”custom” videos=”621025,617012,591858″]

Xiaomi’s low margin business model is also being adopted by other companies in the Chinese and Asians markets, which is pushing prices down for consumers but making profits tougher to come-by. Xiaomi is gradually turning its attention to the US, in a bid to expand out from the ultra-competitive Asian markets.

Lenovo has seen a more modest jump in its shipments, just 400,000, and has seen its share in China squeezed slightly by other low cost manufacturers. However, sales of Motorola devices, especially the entry level Moto E and G smartphones, have sold well across the globe, from India to the US.

In summary, it has been another good year for most of the world’s smartphone vendors. Some are doing better than others and this year’s biggest winners so far appear to be Apple, HUAWEI and Xiaomi, while Samsung is still struggling after a lacklustre 2014. With each passing year the competitive environments in both the high-end and entry-level markets are becoming increasingly unforgiving.

These days, comparable hardware can be bought at half the price of expensive flagships from Samsung or Apple, and this is one of the leading reasons for the huge growth from the Asian brands. However, there are signs of growth in the high-end Chinese market as well, which Android brands do not seem to be capitalizing on right now.

Following a tough time with its Galaxy S5, a misjudgement seems to have also cost Samsung with the S6. At the other end, low-cost manufacturers are looking expand away from the Chinese market in search of further growth. There are opportunities to boost sales with low-cost devices in Western markets and whoever gets there first might secure themselves a spot in the top 5 for the coming years.