Affiliate links on Android Authority may earn us a commission. Learn more.

Why US carriers won't sell the best phone in the world

Published onJanuary 12, 2018

Behind the Alexa vs Assistant war playing out at CES 2018, the fallout from HUAWEI’s scuppered deal with carrier AT&T is the biggest story right now.

The implications and ramifications are massive for HUAWEI. Don’t be fooled; this is a huge shake-up. There’s little wonder Richard Yu, the CEO of HUAWEI’s consumer products division, went a little off-kilter in his CES presentation, showing genuine pain at the decision.

This leaves the third largest smartphone manufacturer in the world without a partner in the world’s largest market for premium smartphones. Given 90 percent of mobile sales occur through carriers — a number cited by Yu himself — HUAWEI will now be forced to renew their focus on Europe and Asia to keep growing.

The decision protects both Android manufacturers and Apple from a strong competitor muscling in. After all, Android Authority deemed HUAWEI’s Mate 10 Pro our Phone Of The Year after an exhaustive 40 individual tests with more than 100 different criteria.

Richard Yu announcing that the Mate 10 Pro is coming to the US. #CES2018 pic.twitter.com/F2Gg9nXNnl— Android Authority (@AndroidAuth) January 9, 2018

HUAWEI had been spending big in advance of the Mate 10 Pro release, with a serious marketing warchest ready for deployment. Mate 10 Pro advertising had been noticeable around CES 2018 and Las Vegas, after a successful launch in Munich, Germany, in anticipation of the AT&T deal.

News leaked as far back as March 2017 that HUAWEI and AT&T were working on a deal, and in August has “tentatively agreed” on a partnership. According to The Information, both parties had committed significant resources, including a $100 million marketing effort from HUAWEI, and engineers from the company had been in the U.S. working with AT&T to ensure a smooth rollout.

The Mate 10 Pro will still go on sale in the U.S., as we reported earlier, and consumers will be able to use it on networks with GSM like AT&T and T-Mobile. But without the partnership of a carrier, any prospect of the Mate 10 Pro being a U.S. bestseller is now gone. It will be years before HUAWEI tries again.

The reasoning behind the ban appears to be a bipartisan response, based on issues brought forward by Intelligence Committees regarding Chinese government influence and potential for espionage. The U.S. Senate and House intelligence committees wrote a classified letter to the FCC raising security concerns, cited by The Information, the letter reported as stating:

“Additional work by the Intelligence Committees on this topic only reinforces concerns regarding HUAWEI and Chinese espionage.”

The idea that AT&T or HUAWEI walked away for commercial reasons or due to issues of bloatware from either party can be dispelled from here — this came from higher up.

This isn’t the first time HUAWEI’s been blocked form operating in the U.S. either. The company manufactures and sells high-end telecommunications equipment and tech for carriers and ISPs; the full stack, from processors to back-end, consumer, and cloud technology. Under the Obama administration, a U.S. cyber-espionage law limited the importation and use of Chinese-made information technology products, specifically targeting HUAWEI and ZTE telecommunication tech for carriers. That trend looks set to continue following the latest Senate bill.

A declassified report released in 2012 doesn’t provide evidence or conclusive answers

A declassified report titled “Investigative Report on the U.S. National Security Issues Posed by Chinese Telecommunications Companies HUAWEI and ZTE” released in 2012 elaborates, but doesn’t provide evidence or conclusive answers. More than anything, it notes insufficient evidence provided from the companies, the risks to critical assets, as well as alleged intellectual property thefts from the past. One oft-raised point of suspicion is the company was founded by Ren Zhengfei, a former engineer in the People’s Liberation Army.

The U.S. is not alone amongst its close allies in its suspicion, though it has been the most cautious. The Australian government banned (and renewed a ban) on HUAWEI backend technology for networks, but allows consumer electronics to partner with carriers. Both Britain and New Zealand have been more lenient on HUAWEI supplying telecom equipment. Canada has been wary.

Australia ruled HUAWEI could not bid on the country’s National Broadband Network (NBN) infrastructure. The left-leaning Labor party instigated the ban while in government, and when removed from government by the opposition, it appeared HUAWEI would be allowed back into the fold. That ended abruptly after a briefing to ministers by Australian national security agencies.

It was later revealed HUAWEI had courted senior government figures via sponsored trips and hospitality. In addition, a former government official and one-time party leader, now Australia’s ambassador to London, Alexander Downer, sat on the board of the Australian arm of HUAWEI during this period. (Downer was recently in the news for his apparent role in passing on information from Trump aide George Papadopoulos, whose actions instigated the FBI’s Trump-Russian investigation.)

Specific evidence has never been made public, but the factors at play have been laid out. Former CIA and NSA director Michael Hayden told the Australian media in 2013 HUAWEI “has spied for the Chinese government, and intelligence agencies have hard evidence of its activities.”

HUAWEI made strenuous denials in a cybersecurity white paper.

“We can confirm that we have never been asked to provide access to our technology, or provide any data or information on any citizen or organization to any Government, or their agencies,” the company stated.

In a somewhat ironic but important twist, documents from Edward Snowden showed the NSA has allegedly been spying on HUAWEI’s servers for years. The same documents also showed AT&T had been very willing in assisting the NSA with surveillance.

HUAWEI has still managed to become a global leader in network infrastructure, making significant inroads in Europe, across U.S. allies like Germany. In fact Europe is its largest market. Security concerns are often raised and shouted down by HUAWEI, but third-party experts aren’t sure.

There’s a broad distrust of Chinese business, which is seen as an extension of the Chinese government.

“Network equipment is a backdoor. If governments determine it is okay to use HUAWEI products, that’s their determination. We have to respect that. They see this as a risk they’re willing to take,” Anthony Ferrante, consulting firm FTI’s global head of cybersecuritym told Politico late last year. Ferrante previously advised president Barack Obama on cybersecurity on the National Security Council.

There’s also a broader distrust of Chinese business in the United States, as it is seen as an extension of the Chinese government.

A backdoor security exploit purposefully pre-installed by a Chinese ad company on cheap Android phones sold in the United States collected the data of hundreds of thousands of people.

According to the New York Times report on the hack, “American authorities say it is not clear whether this represents secretive data mining for advertising purposes or a Chinese government effort to collect intelligence.”

This indistinguishable problem once data leaves U.S. shores is very serious.

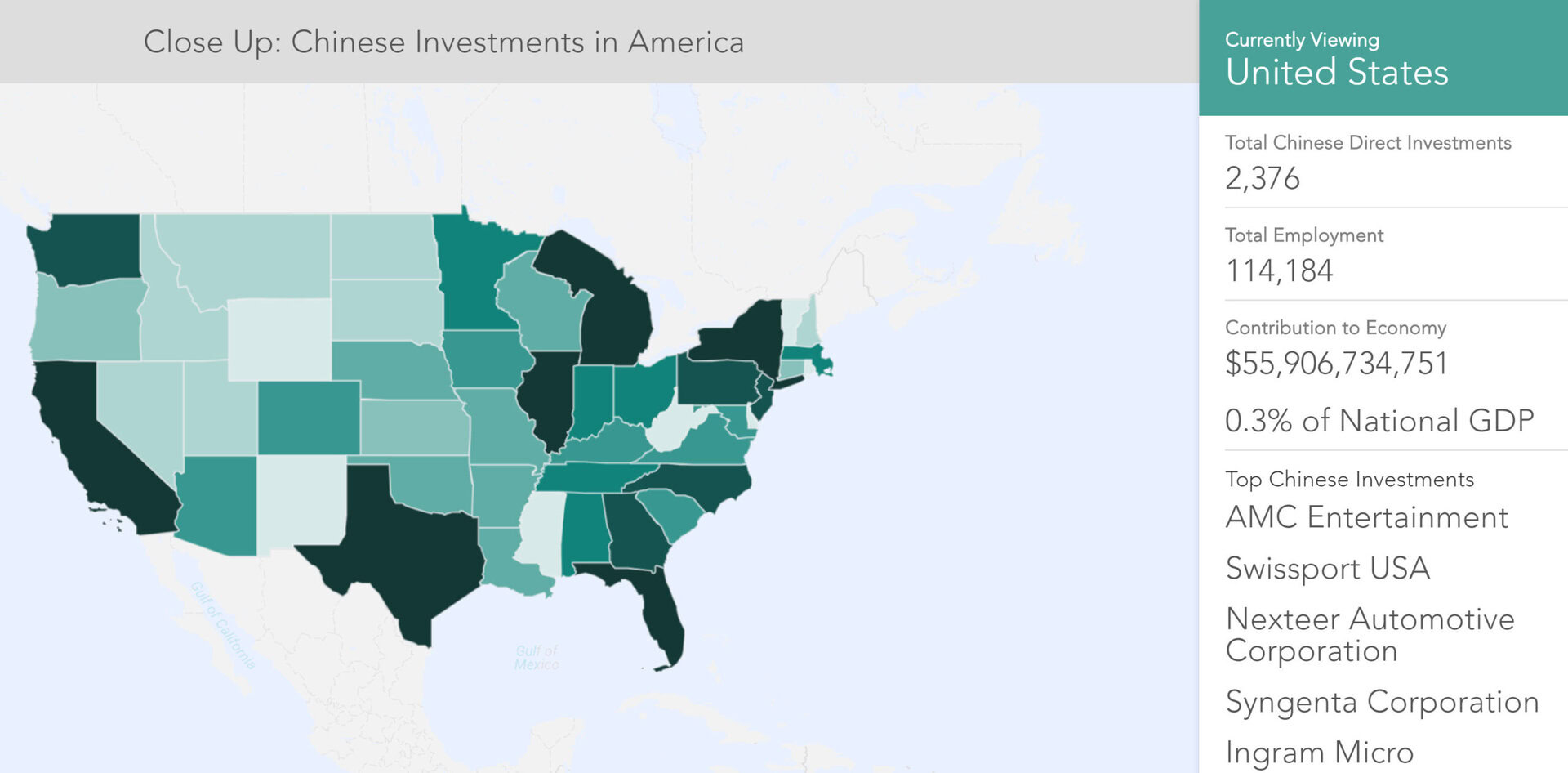

According to trove of open-source data from China-watcher MacroPolo published this week, Chinese investors and firms own a majority of nearly 2,400 American companies employing more than 114,000 people. The investments are a divisive topic for the U.S. both in security and politics.

Lobbying for U.S. protections may also be at play. We know U.S. companies like Apple and Qualcomm are spending record amounts on lobbying. It isn’t far-fetched to believe ears are more receptive under the Trump administration’s “America First” policy to limits on Chinese competition with major employers of homegrown industry. It’s certain HUAWEI, across their stack of high-tech hardware production, is growing the muscle to compete with Apple, Qualcomm, Intel, Google, and so on. Samsung, of course, is enormously capable as well, but being based in South Korea, a staunch U.S. ally, could work in its favor.

China’s retaliation

The reaction to HUAWEI’s exclusion is likely to see some retaliation from China, although it may be softened by a few factors. The first is that intriguingly, HUAWEI phones are not completely banned despite the classified allegations. Nor are HONOR phones, the more budget-friendly sub-brand of HUAWEI. AT&T even partnered with ZTE, a Chinese rival of HUAWEI, to stock the ZTE Axon M. Remember, ZTE Corporation was also featured in that 2012 Intelligence Committee report.

China already has made life difficult for American tech companies. Facebook remains banned, as does Twitter. Google remains largely blocked out. Only Apple has a significant presence, though it’s under pressure from local manufacturers like HUAWEI, OPPO, and OnePlus, who are making quality smartphones at bargain prices.

Apple, too, must continue to dance to the requirements of the People’s Republic of China:

Apple on Wednesday announced its decision to relocate Chinese mainland customers’ iCloud data from the U.S. to China, promising that the relocation will not compromise users’ information security pic.twitter.com/AYIvFNnMUF— People’s Daily,China (@PDChina) January 10, 2018

The official response to the HUAWEI/AT&T fallout should be fascinating to see.

The 5G problem

Huawei’s telecommunications strengths have made them a leader in fifth-generation wireless systems, or 5G, and the company is aggressively pursuing new standards and partnerships. It is increasingly unlikely that the U.S. can avoid HUAWEI technology in the near-future.

The Chinese company holds ten percent of 5G patents alone. ZTE holds another five percent. HUAWEI in particular is fiercely competing with Europe’s Ericsson and Nokia, as well as ZTE, to deliver 5G network technology. It spent $11.8 billion on research and development in 2016 — dwarfing Ericsson and Nokia, who could only muster $3.8 billion and $5.9 billion respectively — and has a commanding position in terms of both equipment capability and cost. Both European companies bring in less revenue than HUAWEI and are facing challenging conditions in 2018. Some have even suggested the pair will merge to stay viable.

In Europe, HUAWEI has joint ventures with an impressive array of telecom companies to work on 5G technology, including Vodafone, Deutsche Telekom, Telefónica, and Orange. HUAWEI has commanding 5G technology prowess, and offer affordable pricing on their technology.

That poses a problem for major U.S. carriers. A market researcher told Android Authority at least one reason for high carrier fees to consumers is due to the limited presence of HUAWEI in the U.S. One carrier working with HUAWEI has been Union Wireless, who service limited areas in states like Wyoming, Utah, and Colorado. The company isn’t big enough to be treated as a national carrier, which gives them access to HUAWEI.

Chinese telecom infrastructure giants, including HUAWEI, are stocking up on 5G patents.

Union Wireless customer relations chief Brian Woody sang the praises of HUAWEI to the Wall Street Journal.

“We’ve had many vendors over the years. HUAWEI has treated us better than anybody,” said Woody, who only has two competitors to HUAWEI in a shrinking market.

The Wall Street Journal reports $275 billion is to be spent on 5G by U.S. carriers, and noted that AT&T found HUAWEI equipment as much as 70 percent cheaper than competitors. According to reports, AT&T executives met with congressional staffers to pressure them into loosening rules to allow them to service their shareholders.

WSJ report mentioned NSA director Michael Rogers, FBI director James Comey, and AT&T executives meeting to discuss.

What’s really at play

Why U.S. carriers won’t sell the best phone in the world isn’t because they don’t want to. There’s significant demand to buy HUAWEI telecommunications equipment, and sell HUAWEI consumer electronics. This will probably only become more compelling in years to come.

What we’ve seen in declassified reports isn’t conclusive, which makes the political pressure appear to come from a mix of intelligence agency tips, and some point-scoring. Occam’s Razor demands we believe there must be more than what’s been divulged in declassified documents.

The pressure felt after election meddling from Russia, paranoia over cybersecurity from state actors, “America First” policies for U.S. industries, and a general distrust of China, has created a perfect storm against HUAWEI. That pressure is unlikely to lessen any time soon, even as HUAWEI becomes more dominant globally.